Question: Old MathJax webview Old MathJax webview Hey Can Anyone help me in this you can do That part that's easy for you maximum 4 Its

Old MathJax webview

Hey Can Anyone help me in this you can do That part that's easy for you maximum 4

Its Full Question please help am Posting for 3rd time but no one can solve this

i wait any 3,4 parts done for me

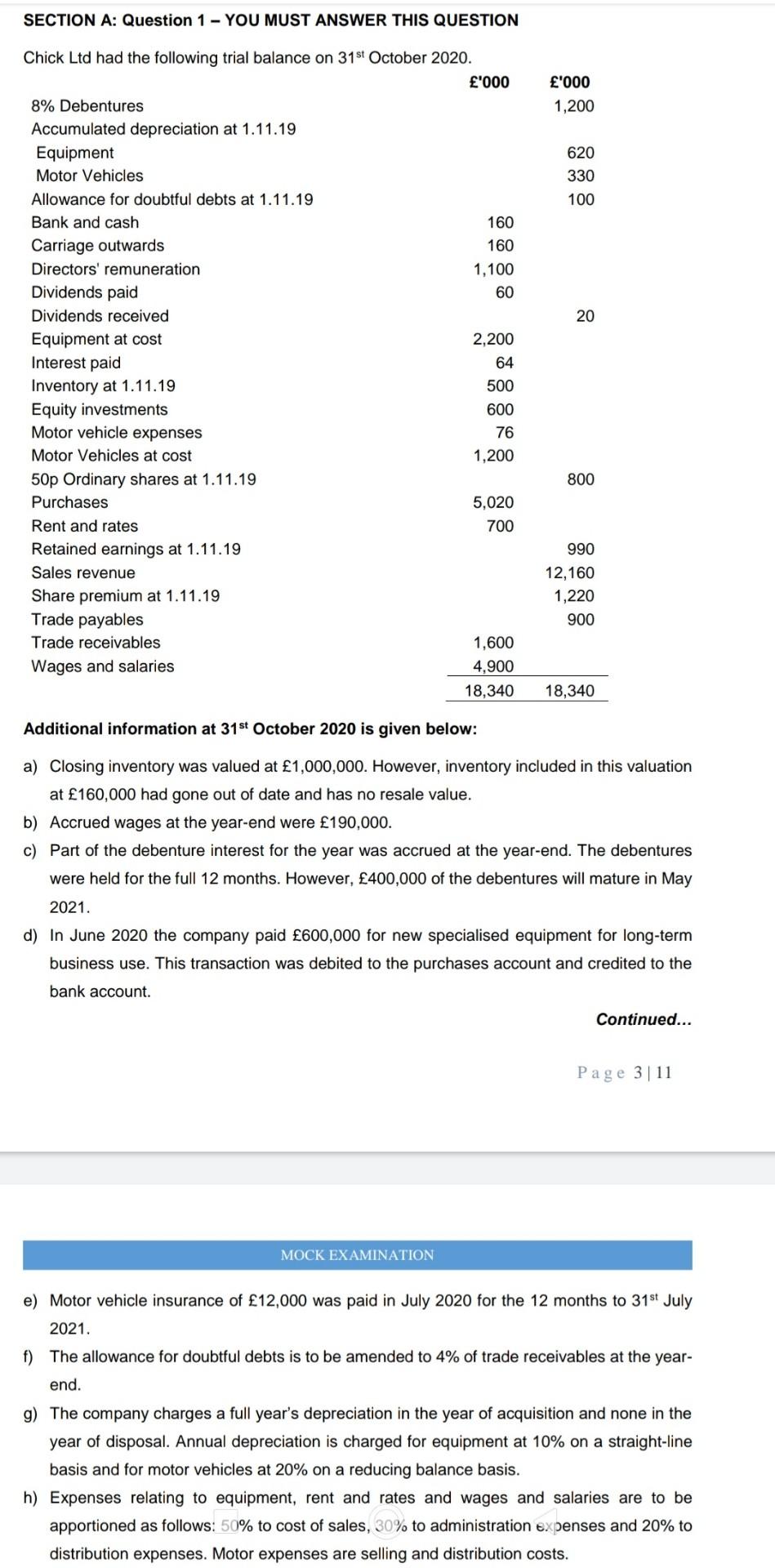

SECTION A: Question 1 - YOU MUST ANSWER THIS QUESTION '000 1,200 620 330 100 20 Chick Ltd had the following trial balance on 31st October 2020. '000 8% Debentures Accumulated depreciation at 1.11.19 Equipment Motor Vehicles Allowance for doubtful debts at 1.11.19 Bank and cash 160 Carriage outwards 160 Directors' remuneration 1,100 Dividends paid 60 Dividends received Equipment at cost 2,200 Interest paid 64 Inventory at 1.11.19 500 Equity investments 600 Motor vehicle expenses 76 Motor Vehicles at cost 1,200 50p Ordinary shares at 1.11.19 Purchases 5,020 Rent and rates 700 Retained earnings at 1.11.19 Sales revenue Share premium at 1.11.19 Trade payables Trade receivables 1,600 Wages and salaries 4,900 18,340 800 990 12,160 1,220 900 18,340 Additional information at 31st October 2020 is given below: a) Closing inventory was valued at 1,000,000. However, inventory included in this valuation at 160,000 had gone out of date and has no resale value. b) Accrued wages at the year-end were 190,000. c) Part of the debenture interest for the year was accrued at the year-end. The debentures were held for the full 12 months. However, 400,000 of the debentures will mature in May 2021. d) In June 2020 the company paid 600,000 for new specialised equipment for long-term business use. This transaction was debited to the purchases account and credited to the bank account. Continued... Page 311 MOCK EXAMINATION e) Motor vehicle insurance of 12,000 was paid in July 2020 for the 12 months to 31st July 2021. f) The allowance for doubtful debts is to be amended to 4% of trade receivables at the year- end. g) The company charges a full year's depreciation in the year of acquisition and none in the year of disposal. Annual depreciation is charged for equipment at 10% on a straight-line basis and for motor vehicles at 20% on a reducing balance basis. h) Expenses relating to equipment, rent and rates and wages and salaries are to be apportioned as follows: 50% to cost of sales, 30% to administration expenses and 20% to distribution expenses. Motor expenses are selling and distribution costs. SECTION A: Question 1 - YOU MUST ANSWER THIS QUESTION '000 1,200 620 330 100 20 Chick Ltd had the following trial balance on 31st October 2020. '000 8% Debentures Accumulated depreciation at 1.11.19 Equipment Motor Vehicles Allowance for doubtful debts at 1.11.19 Bank and cash 160 Carriage outwards 160 Directors' remuneration 1,100 Dividends paid 60 Dividends received Equipment at cost 2,200 Interest paid 64 Inventory at 1.11.19 500 Equity investments 600 Motor vehicle expenses 76 Motor Vehicles at cost 1,200 50p Ordinary shares at 1.11.19 Purchases 5,020 Rent and rates 700 Retained earnings at 1.11.19 Sales revenue Share premium at 1.11.19 Trade payables Trade receivables 1,600 Wages and salaries 4,900 18,340 800 990 12,160 1,220 900 18,340 Additional information at 31st October 2020 is given below: a) Closing inventory was valued at 1,000,000. However, inventory included in this valuation at 160,000 had gone out of date and has no resale value. b) Accrued wages at the year-end were 190,000. c) Part of the debenture interest for the year was accrued at the year-end. The debentures were held for the full 12 months. However, 400,000 of the debentures will mature in May 2021. d) In June 2020 the company paid 600,000 for new specialised equipment for long-term business use. This transaction was debited to the purchases account and credited to the bank account. Continued... Page 311 MOCK EXAMINATION e) Motor vehicle insurance of 12,000 was paid in July 2020 for the 12 months to 31st July 2021. f) The allowance for doubtful debts is to be amended to 4% of trade receivables at the year- end. g) The company charges a full year's depreciation in the year of acquisition and none in the year of disposal. Annual depreciation is charged for equipment at 10% on a straight-line basis and for motor vehicles at 20% on a reducing balance basis. h) Expenses relating to equipment, rent and rates and wages and salaries are to be apportioned as follows: 50% to cost of sales, 30% to administration expenses and 20% to distribution expenses. Motor expenses are selling and distribution costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts