Question: 3) Please answer following three questions based on the direct quotes from the spot and forward markets for pounds, yens and pesos, for three points

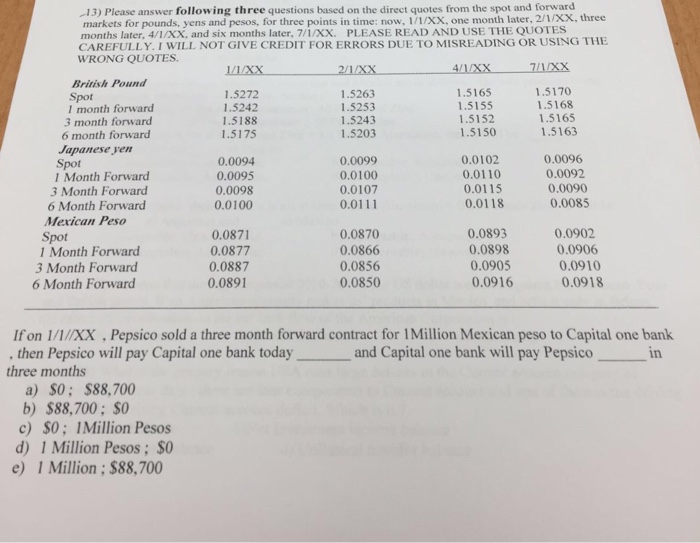

3) Please answer following three questions based on the direct quotes from the spot and forward markets for pounds, yens and pesos, for three points in time: now, 1/1/XX, one month later, 2/1/XX, three months later, 4/1/XX, and six months later, 7/1/XX. PLEASE READ AND USE THE QUOTES CAREFULLY.I WILL NOT GIVE CREDIT FOR ERRORS DUE TO MISREADING OR USING THE WRONG QUOTES British Pound 1.5170 1.5263 1.5253 1.5243 1.5203 1.5165 1.5155 1.5152 1.5150 1.5272 Spot I month forward 3 month forward 6 month forward 1.5242 1.5188 1.5175 1.5168 1.5165 1.5163 Japanese yen Spot 0.0096 0.0092 1 Month Forward 3 Month Forward 6 Month Forward 0.0094 0.0095 0.0098 0.0100 0.0099 0.0100 0.0107 0.0111 0.0102 0.0110 0.0115 0.0118 0.0090 0.0085 Mexican Peso 0.0871 0.0877 0.0887 0.0870 0.0866 0.0856 0.0850 0.0893 0.0898 0.0905 0.0902 0.0906 0.0910 0.0918 Spot 1 Month Forward 3 Month Forward 6 Month Forward 0.0891 0.0916 If on 1///XX , Pepsico sold a three month forward contract for lMillion Mexican peso to Capital one bank , then Pepsico will pay Capital one bank today three months and Capital one bank will pay Pepsico in a) SO $88,700 b) $88,700; so c) SO; IMillion Pesos d) 1 Million Pesos; s e) 1 Million: $88,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts