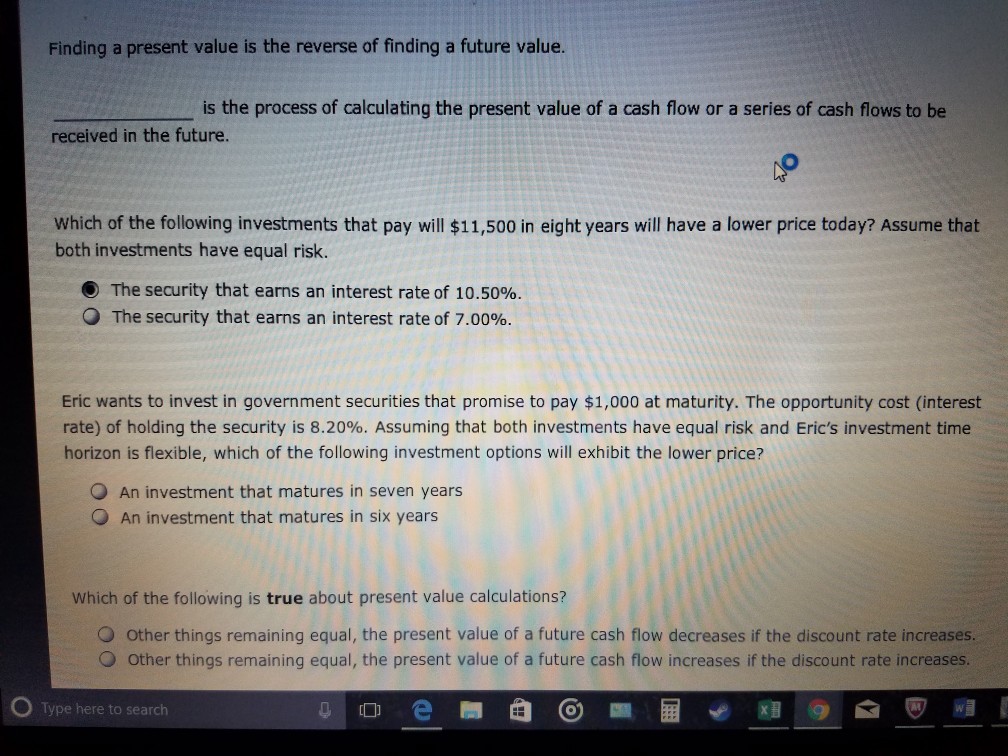

Question: 3. present value Finding a present value is the reverse of finding a future value is the process of calculating the present value of a

3. present value

Finding a present value is the reverse of finding a future value is the process of calculating the present value of a cash flow or a series of cash flows to be received in the future. 0 which of the following investments that pay will $11,500 in eight years will have a lower price today? Assume that both investments have equal risk. The security that earns an interest rate of 10.50%. The security that earns an interest rate of 7.00%. Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost (interest rate) of holding the security is 8.20%. Assuming that both investments have equal risk and Eric's investment time horizon is flexible, which of the following investment options will exhibit the lower price? O An investment that matures in seven years O An investment that matures in six years Which of the following is true about present value calculations? other things remaining equal, the present value of a future cash flow decreases if the discount rate increases. O Other things remaining equal, the present value of a future cash flow increases if the discount rate increases 0 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts