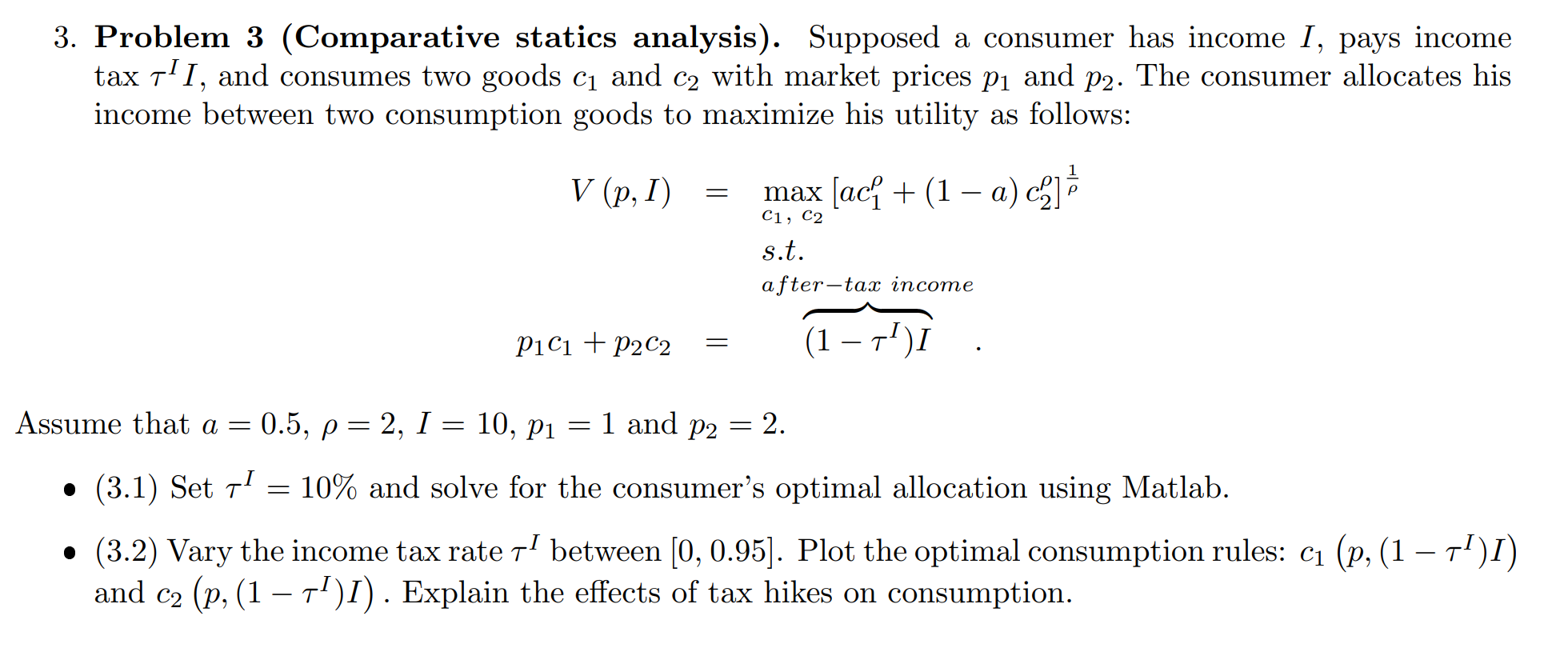

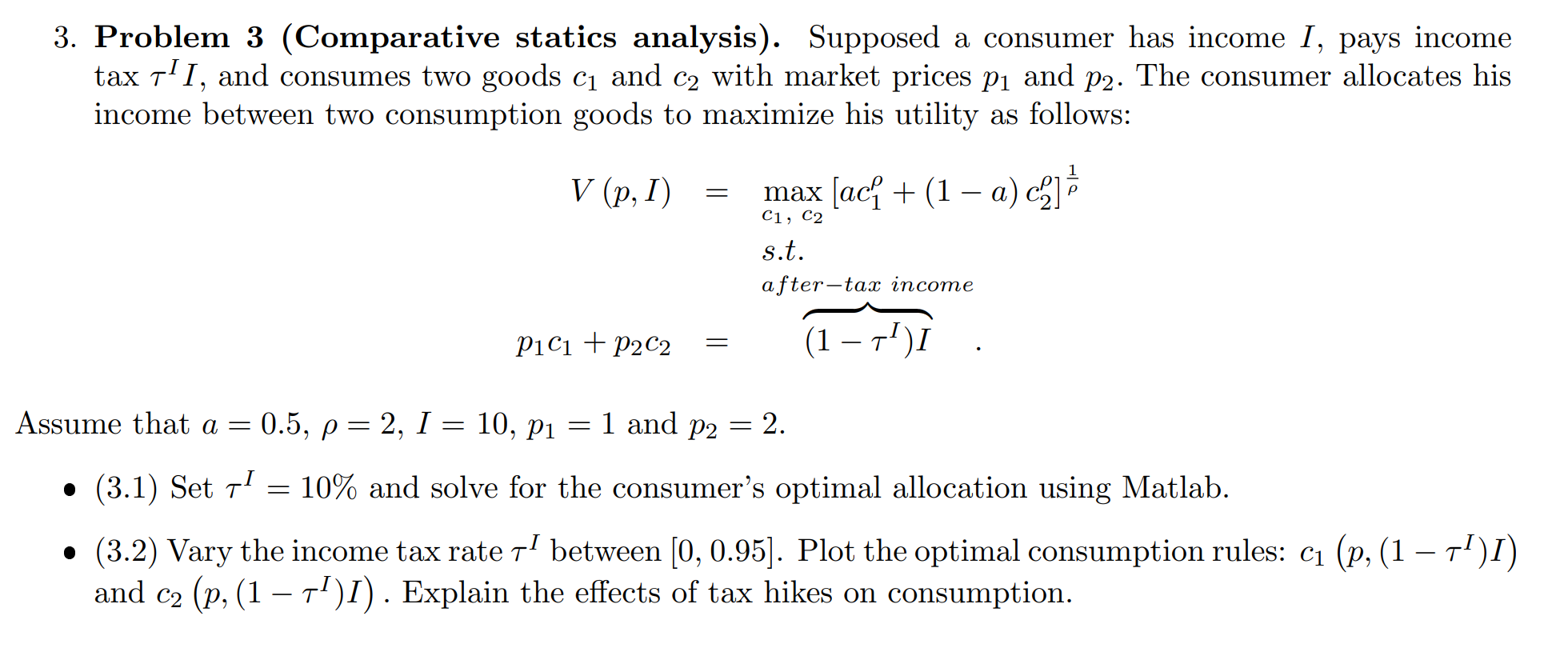

Question: 3. Problem 3 (Comparative statics analysis). Supposed a consumer has income I . pays income tax 7'1 I , and consumes two goods 01 and

3. Problem 3 (Comparative statics analysis). Supposed a consumer has income I . pays income tax 7'1 I , and consumes two goods 01 and Cg with market prices 191 and p2. The consumer allocates his income between two consumption goods to maximize his utility as follows: 1 v (12.1) = max [ac'f + (1 a) c5]? Ci, C2 at. aftertam income I 19101 +p202 = (1 7' )1 Assume that a = 0.5, p = 2, I = 10,191 :1 and p2 = 2. o (3.1) Set 7'1 = 10% and solve for the consumer's optimal allocation using Matlab. o (3.2) Vary the income tax rate 7'1 between [0, 0.95]. Plot the optimal consumption rules: 61 (p, (1 TI)I) and Cg (p, (1 TI)I) . Explain the effects of tax hikes on consumption

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts