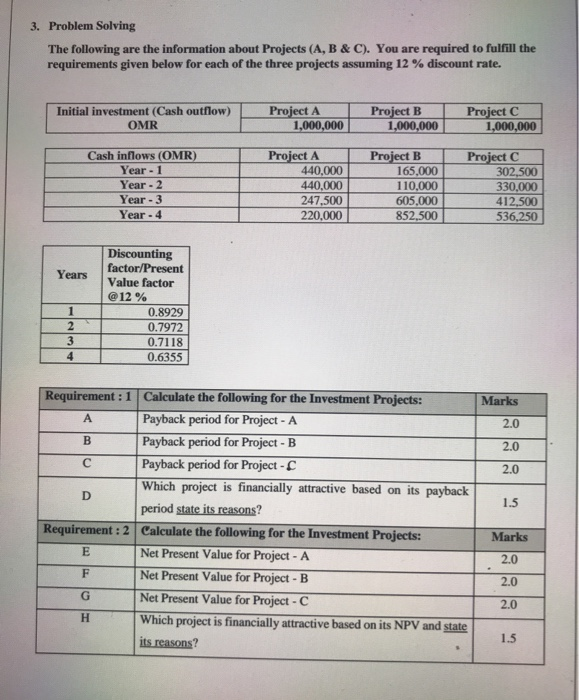

Question: 3. Problem Solving The following are the information about Projects (A, B & C). You are required to fulfill the requirements given below for each

3. Problem Solving The following are the information about Projects (A, B & C). You are required to fulfill the requirements given below for each of the three projects assuming 12% discount rate. Initial investment (Cash outflow) OMR Project A 1,000,000 Project B 1,000,000 Project C 1,000,000 Project B Project C Cash inflows (OMR) Year.1 Year - 2 Year - 3 Year - 4 Project A 440,000 440,000 247,500 220.000 110,000 605.000 852,500 330,000 412.500 536,250 Years Discounting factor/Present Value factor @ 12% 0.8929 0 .7972 0.7118 0.6355 1 2 4 Marks 2.0 2.0 2.0 1.5 Requirement: 1 Calculate the following for the Investment Projects: A Payback period for Project - A B Payback period for Project - B Payback period for Project - Which project is financially attractive based on its payback period state its reasons? Requirement: 2 Calculate the following for the Investment Projects: E Net Present Value for Project - A F Net Present Value for Project - B Net Present Value for Project - C Which project is financially attractive based on its NPV and state its reasons? Marks 2.0 2.0 1.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts