Question: 3 pts Question 15 Consider the dollar- and euro-based borrowing opportunities of companies A and B. A is a US-based MNC with AAA credit: Bis

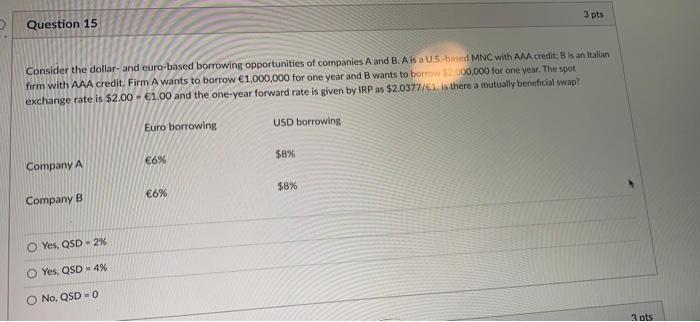

3 pts Question 15 Consider the dollar- and euro-based borrowing opportunities of companies A and B. A is a US-based MNC with AAA credit: Bis an Italian firm with AAA credit. Firm A wants to borrow 1,000,000 for one year and B wants to borrow $2.000.000 for one year. The spot exchange rate is $2.00 - 1.00 and the one-year forward rate is given by IRP as $2.0377/6. Is there a mutually beneficial swap? Euro borrowing USD borrowing 6% $8% Company A $8% 6% Company B Yes, QSD = 2% Yes, QSD-4% 0 No, QSD= 0 3 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts