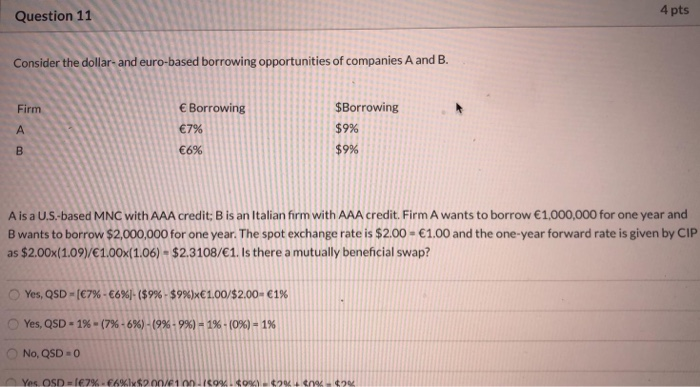

Question: 4 pts Question 11 Consider the dollar- and euro-based borrowing opportunities of companies A and B Borrowing $Borrowing Firm $9% 7% A $99% 6% B

4 pts Question 11 Consider the dollar- and euro-based borrowing opportunities of companies A and B Borrowing $Borrowing Firm $9% 7% A $99% 6% B A is a U.S-based MNC with AAA credit: B is an Italian firm with AAA credit. Firm A wants to borrow 1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = 1.00 and the one-year forward rate is given by CIP as $2.00x(1.09)/1.00x(1.06)-$2.3108/1. Is there a mutually beneficial swap? Yes, QSD [E7 % -6% )- ($ 99% - $ 99 % )x1.00/$2.00- 1 %| Yes, QSD 1 % -(7 %-6 % ) - ( 9 9% -9 % ) - 1 % - ( 0 % ) - 1 % No, QSD 0 Yes OSD (7% -6 %lx $200/E1.00-ico%co t2 tnet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts