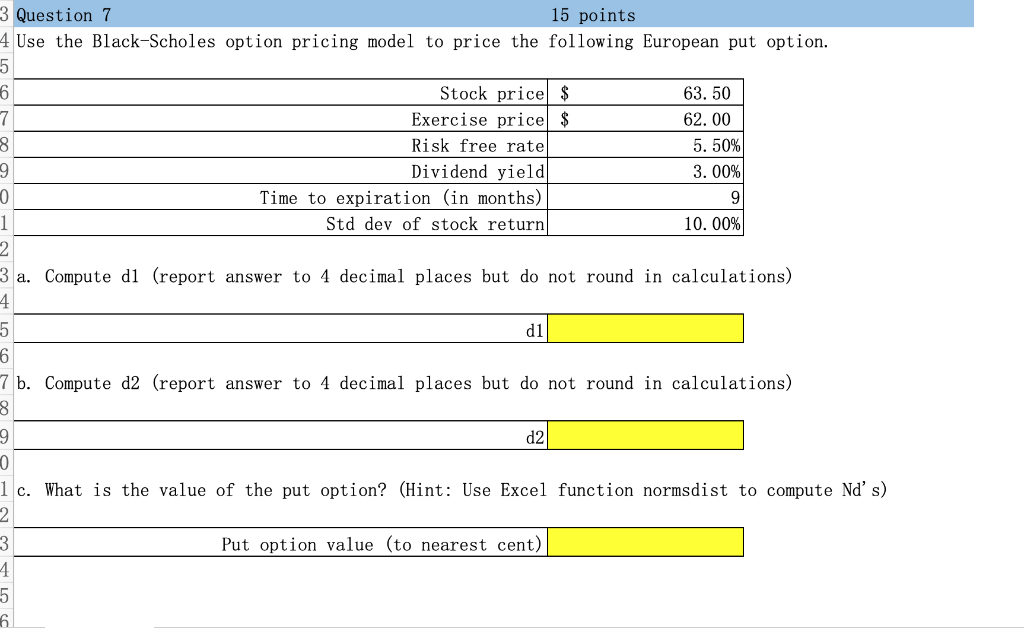

Question: 3 Question 7 4 Use the Black-Scholes option pricing model to price the following European put option 15 points 63. 50 62. 00 Stock price$

3 Question 7 4 Use the Black-Scholes option pricing model to price the following European put option 15 points 63. 50 62. 00 Stock price$ Exercise price $ 5.50%) 3. 00% Risk free rate Dividend yield Time to expiration (in months) Std dev of stock return 10. 00%) 3 a. Compute d1 (report answer to 4 decimal places but do not round in calculations) dl 7 b. Compute d2 (report answer to 4 decimal places but do not round in calculations) d2 1c. What is the value of the put option? (Hint: Use Excel function normsdist to compute Nd' s) Put option value (to nearest cent)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock