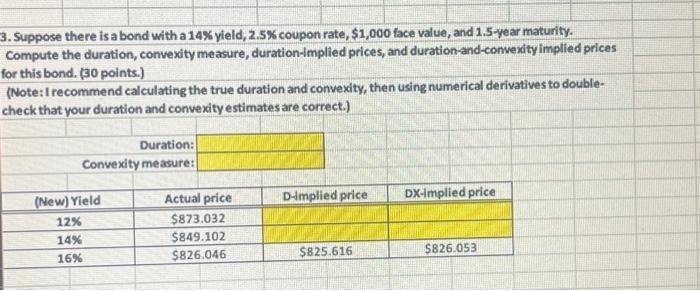

Question: 3. Suppose there is a bond with a 14% yield, 2.5% coupon rate, $1,000 face value, and 1.5-year maturity. Compute the duration, convexity measure,

3. Suppose there is a bond with a 14% yield, 2.5% coupon rate, $1,000 face value, and 1.5-year maturity. Compute the duration, convexity measure, duration-implied prices, and duration-and-convexity implied prices for this bond. (30 points.) (Note: I recommend calculating the true duration and convexity, then using numerical derivatives to double- check that your duration and convexity estimates are correct.) Duration: Convexity measure: (New) Yield Actual price D-implied price DX-implied price 12% $873.032 14% $849.102 16% $826.046 $825.616 $826.053

Step by Step Solution

There are 3 Steps involved in it

To calculate the duration and convexity of the bond with the given characteristics Yield 14 Coupon r... View full answer

Get step-by-step solutions from verified subject matter experts