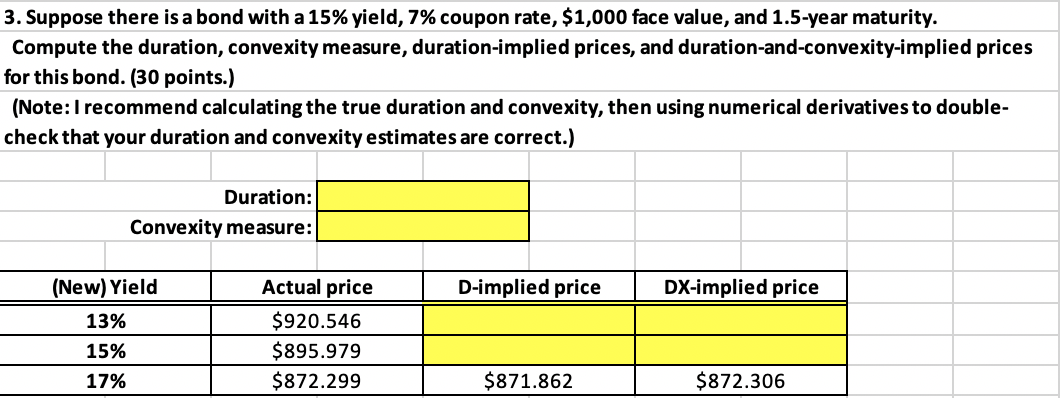

Question: 3. Suppose there is a bond with a 15% yield, 7% coupon rate, $1,000 face value, and 1.5-year maturity. Compute the duration, convexity measure, duration-implied

3. Suppose there is a bond with a 15% yield, 7% coupon rate, $1,000 face value, and 1.5-year maturity. Compute the duration, convexity measure, duration-implied prices, and duration-and-convexity-implied prices for this bond. (30 points.) (Note: I recommend calculating the true duration and convexity, then using numerical derivatives to double- check that your duration and convexity estimates are correct.) Duration: Convexity measure: D-implied price DX-implied price (New) Yield 13% 15% 17% Actual price $920.546 $895.979 $872.299 $871.862 $872.306 3. Suppose there is a bond with a 15% yield, 7% coupon rate, $1,000 face value, and 1.5-year maturity. Compute the duration, convexity measure, duration-implied prices, and duration-and-convexity-implied prices for this bond. (30 points.) (Note: I recommend calculating the true duration and convexity, then using numerical derivatives to double- check that your duration and convexity estimates are correct.) Duration: Convexity measure: D-implied price DX-implied price (New) Yield 13% 15% 17% Actual price $920.546 $895.979 $872.299 $871.862 $872.306

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts