Question: 3. The client plans to construct a 15-year lasting building for hosting annual events. For this project, the client is considering two different financial plans

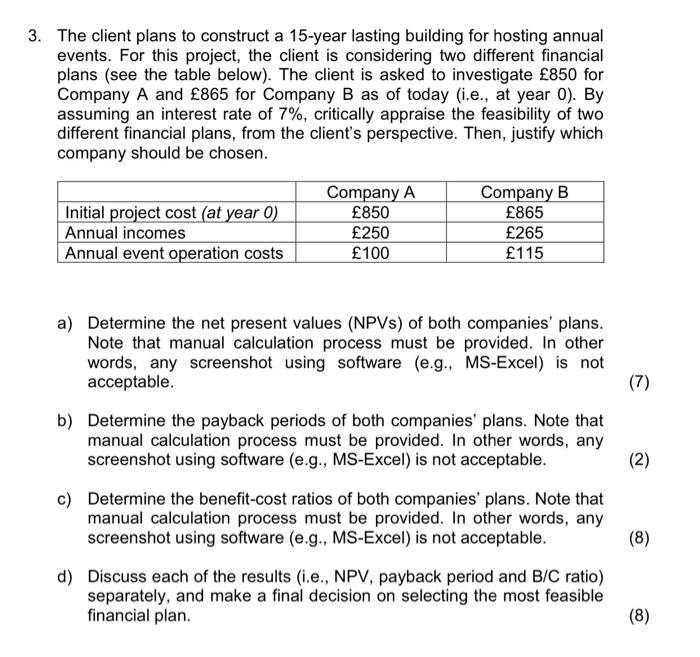

3. The client plans to construct a 15-year lasting building for hosting annual events. For this project, the client is considering two different financial plans (see the table below). The client is asked to investigate 850 for Company A and 865 for Company B as of today (i.e., at year 0). By assuming an interest rate of 7%, critically appraise the feasibility of two different financial plans, from the client's perspective. Then, justify which company should be chosen. Initial project cost (at year 0) Annual incomes Annual event operation costs Company A 850 250 100 Company B 865 265 115 a) Determine the net present values (NPVs) of both companies' plans. Note that manual calculation process must be provided. In other words, any screenshot using software (e.g., MS-Excel) is not acceptable. (7) (2) b) Determine the payback periods of both companies' plans. Note that manual calculation process must be provided. In other words, any screenshot using software (e.g., MS-Excel) is not acceptable. c) Determine the benefit-cost ratios of both companies' plans. Note that manual calculation process must be provided. In other words, any screenshot using software (e.g., MS-Excel) is not acceptable. d) Discuss each of the results (i.e., NPV, payback period and B/C ratio) separately, and make a final decision on selecting the most feasible financial plan. (8) (8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts