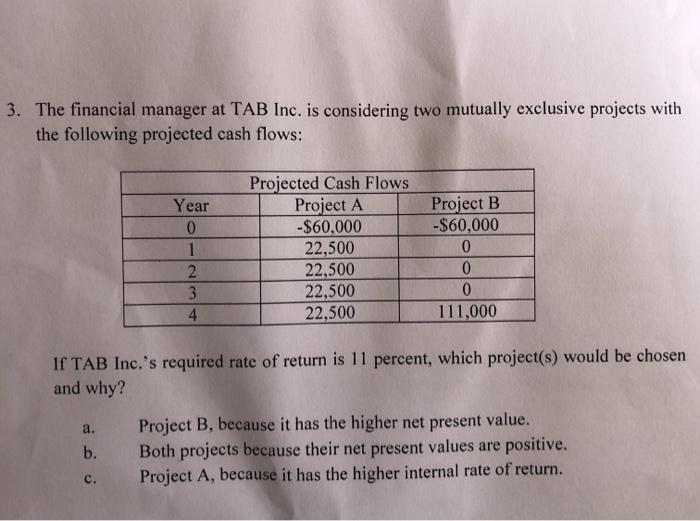

Question: 3. The financial manager at TAB Inc. is considering two mutually exclusive projects with the following projected cash flows: Year 0 1 2 3 4

3. The financial manager at TAB Inc. is considering two mutually exclusive projects with the following projected cash flows: Year 0 1 2 3 4 Projected Cash Flows Project A -$60,000 22,500 22,500 22,500 22,500 Project B -$60,000 0 0 0 111,000 If TAB Inc.'s required rate of return is 11 percent, which project(s) would be chosen and why? a. b. Project B, because it has the higher net present value. Both projects because their net present values are positive. Project A, because it has the higher internal rate of return. c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock