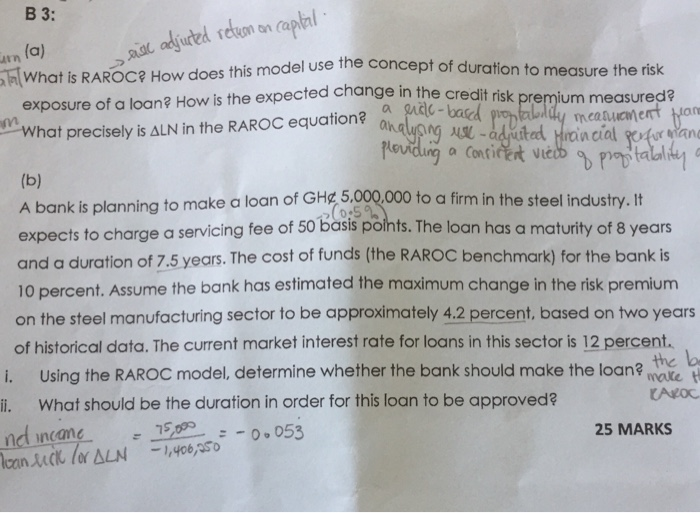

Question: 3: urn (a) What is RAROC? How does this model use the concep exposure of a loan? How is the expected chang t of duration

3: urn (a) What is RAROC? How does this model use the concep exposure of a loan? How is the expected chang t of duration to measure the risk e in the credit risk premium measured? n0 what precisely is ALNin the RAROC eqao measucet an A bank is planning to make a loan of GHg 5,000,000 to a expects to charge a servicing fee of 50 basis poihts. The loan has a maturity of s years and a duration of 7.5 years. The cost of funds (the RAROC benchmark) for the bank is 10 percent. Assume the bank has estimated the maximum change in the risk premium on the steel manufacturing sector to be approximately 4.2 percent, based on two years of historical data. The current market interest rate for loans in this sector is 12 percent a firm in the steel industry.t i. Using the RAROC model, determine whether the bank should make the loan? e i. What should be the duration in order for this loan to be approved? nd n the b me 25 MARKS 3: urn (a) What is RAROC? How does this model use the concep exposure of a loan? How is the expected chang t of duration to measure the risk e in the credit risk premium measured? n0 what precisely is ALNin the RAROC eqao measucet an A bank is planning to make a loan of GHg 5,000,000 to a expects to charge a servicing fee of 50 basis poihts. The loan has a maturity of s years and a duration of 7.5 years. The cost of funds (the RAROC benchmark) for the bank is 10 percent. Assume the bank has estimated the maximum change in the risk premium on the steel manufacturing sector to be approximately 4.2 percent, based on two years of historical data. The current market interest rate for loans in this sector is 12 percent a firm in the steel industry.t i. Using the RAROC model, determine whether the bank should make the loan? e i. What should be the duration in order for this loan to be approved? nd n the b me 25 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts