Question: 3. Using the 2005 P&L data in Exhibit 2, try calculating the following. a) How many patients could Dr. Hoopes lose before Hoopes Vision becomes

3. Using the 2005 P&L data in Exhibit 2, try calculating the following.

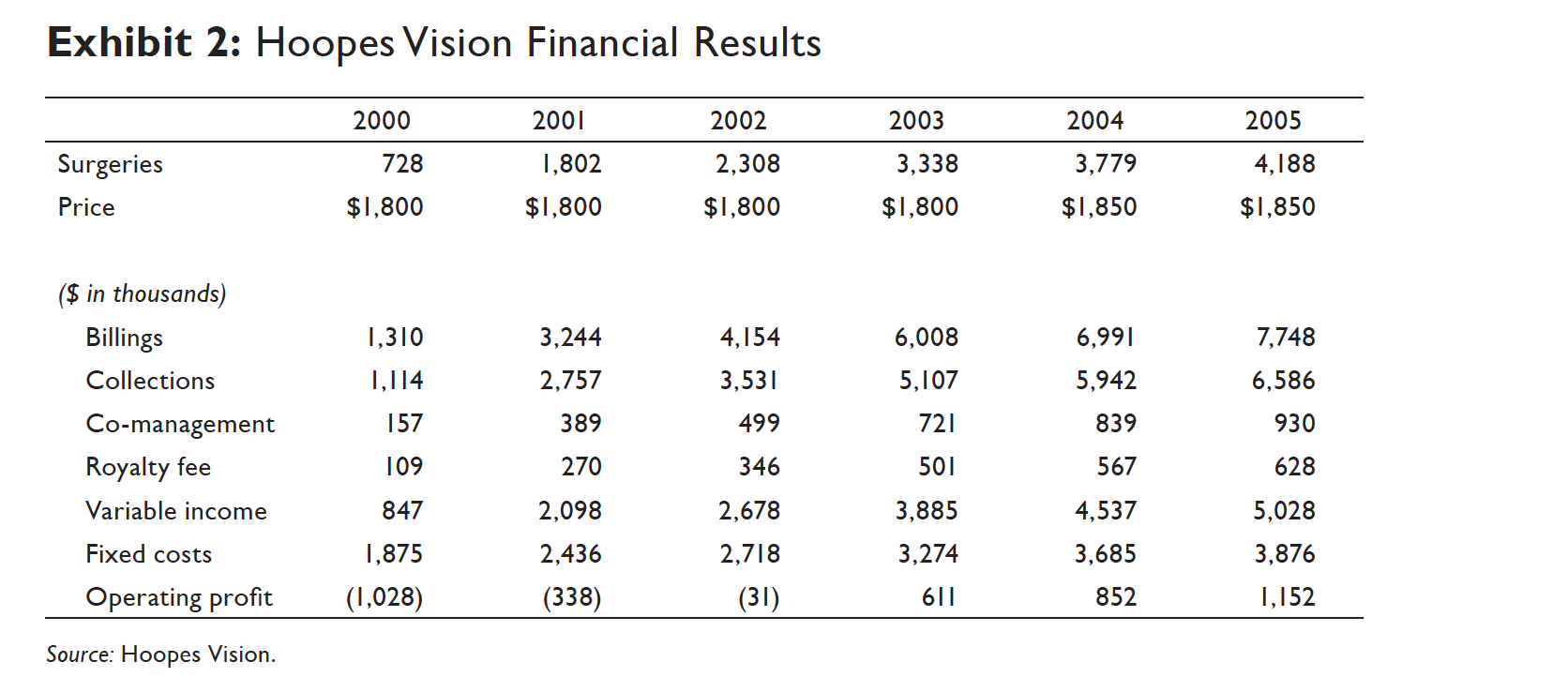

a) How many patients could Dr. Hoopes lose before Hoopes Vision becomes unprofitable? Remember that Hoopes Vision only collects 85% of total billings and that it also has to pay co-management and royalty fees. As such, you should start by using the variable income since this value already takes those things into account. From there, you should be able to figure out how much income each surgery actually brings in on average and, in turn, how many of these surgeries Hoopes Vision could lose before its operating profit turned negative.

b) What would Hoopes Vision's operating profit be if Dr. Hoopes cut the price by 50% to $925 per surgery? Assume the following:

i. The total number of procedures remains flat at 4,188.

ii. Hoopes Vision still collects only 85% of total billings.

iii. Referrals from providers still make up 60% of patients, and co-management fees are still 20% of the amount billed (not collected).

iv. Royalty fees are still $150 per procedure.

v. Fixed costs remain flat at $3,876,000.

c) Using the same assumptions as before, how many additional surgeries would Hoopes Vision have to perform in a year to breakeven at this new $925 price?

Exhibit 2: Hoopes Vision Financial Results 2000 2001 2002 2003 2004 2005 Surgeries 728 1,802 2,308 3,338 3,779 4,188 Price $1,800 $1,800 $1,800 $1,800 $1,850 $1,850 ($ in thousands) Billings 1,310 3,244 4,154 6,008 6,991 7,748 Collections 1, 114 2,757 3,531 5,107 5,942 6,586 Co-management 157 389 499 721 839 930 Royalty fee 109 270 346 501 567 628 Variable income 847 2,098 2,678 3,885 4,537 5,028 Fixed costs 1,875 2,436 2,718 3,274 3,685 3,876 Operating profit (1,028) (338) (31) 611 852 1, 152 Source: Hoopes Vision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts