Question: 3. You work for a U.S.-based firm that has a subsidiary in Egypt. The subsidiary generates substantial earnings in Egyptian pounds (EGP) every year. One

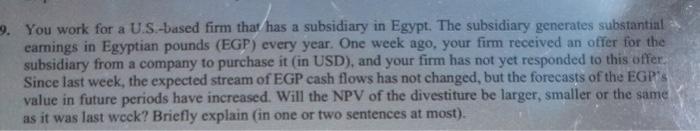

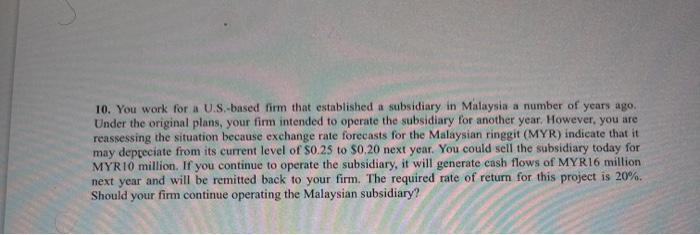

3. You work for a U.S.-based firm that has a subsidiary in Egypt. The subsidiary generates substantial earnings in Egyptian pounds (EGP) every year. One week ago, your firm received an offer for the subsidiary from a company to purchase it (in USD), and your firm has not yet responded to this offer. Since last week, the expected stream of EGP cash flows has not changed, but the forecasts of the EGP'S value in future periods have increased. Will the NPV of the divestiture be larger, smaller or the same as it was last week? Briefly explain (in one or two sentences at most). 10. You work for a U.S.-based firm that established a subsidiary in Malaysia a number of years ago Under the original plans, your fim intended to operate the subsidiary for another year. However, you are reassessing the situation because exchange rate forecasts for the Malaysian ringgit (MYR) indicate that it may depreciate from its current level of $0.25 to $0.20 next year. You could sell the subsidiary today for MYR10 million. If you continue to operate the subsidiary, it will generate cash flows of MYR16 million next year and will be remitted back to your firm. The required rate of return for this project is 20%. Should your firm continue operating the Malaysian subsidiary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts