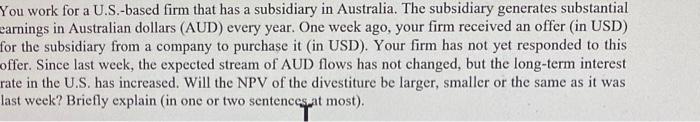

Question: ou work for a U.S.-based firm that has a subsidiary in Australia. The subsidiary generates substantial arnings in Australian dollars (AUD) every year. One week

ou work for a U.S.-based firm that has a subsidiary in Australia. The subsidiary generates substantial arnings in Australian dollars (AUD) every year. One week ago, your firm received an offer (in USD) or the subsidiary from a company to purchase it (in USD). Your firm has not yet responded to this ffer. Since last week, the expected stream of AUD flows has not changed, but the long-term interest ate in the U.S. has increased. Will the NPV of the divestiture be larger, smaller or the same as it was ast week? Briefly explain (in one or two sentencesat most)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock