Question: 10. You work for a U.S.-based firm that has a subsidiary in New Zealand. The subsidiary generates substantial earnings in New Zealand dollars (NZD) every

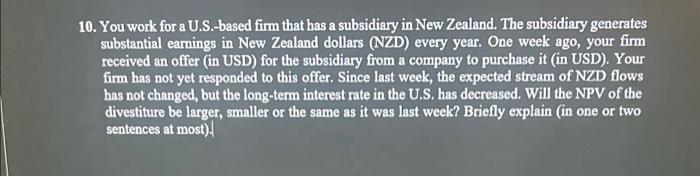

10. You work for a U.S.-based firm that has a subsidiary in New Zealand. The subsidiary generates substantial earnings in New Zealand dollars (NZD) every year. One week ago, your firm received an offer (in USD) for the subsidiary from a company to purchase it (in USD). Your firm has not yet responded to this offer. Since last week, the expected stream of NZD flows has not changed, but the long-term interest rate in the U.S. has decreased. Will the NPV of the divestiture be larger, smaller or the same as it was last week? Briefly explain (in one or two sentences at most)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock