Question: 31,32 U=5 A Caption Normal No Spacing Dictate Editor Replace Select- Editing Voice Editor Paragraph Styles your life expectancy is U+Z more years at that

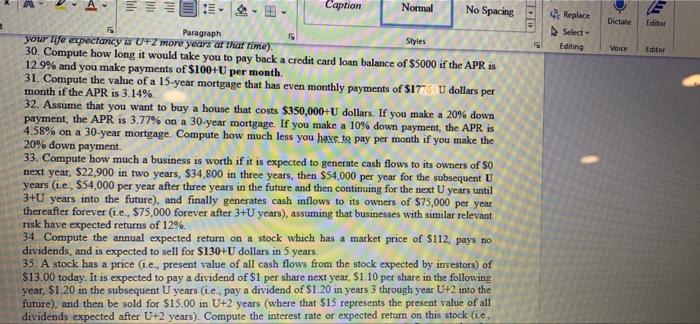

A Caption Normal No Spacing Dictate Editor Replace Select- Editing Voice Editor Paragraph Styles your life expectancy is U+Z more years at that time) 30. Compute how long it would take you to pay back a credit card loan balance of $5000 if the APR is 12.9% and you make payments of $100+U per month. 31. Compute the value of a 15-year mortgage that has even monthly payments of $17 U dollars per month if the APR is 3.14% 32. Assume that you want to buy a house that costs $350,000+U dollars. If you make a 20% down payment, the APR is 3.77% on a 30-year mortgage. If you make a 10% down payment, the APR is 4.58% on a 30-year mortgage. Compute how much less you have to pay per month if you make the 20% down payment 33. Compute how much a business is worth if it is expected to generate cash flows to its owners of 50 next year, $22,900 in two years, $34.800 in three years, then $54,000 per year for the subsequent U years (ie.. $54,000 per year after three years in the future and then continuing for the next years until 3+ years into the future), and finally generates cash inflows to its owners of $75,000 per year thereafter forever (i.e., $75,000 forever after 3+ years), assuming that businesses with similar relevant risk have expected returns of 12%. 34. Compute the annual expected return on a stock which has a market price of $112. pays no dividends, and is expected to sell for $130+U dollars in 5 years 35 A stock has a price (i.e., present value of all cash flows from the stock expected by investors) of $13.00 today. It is expected to pay a dividend of $1 per share next year $1.10 per share in the following year, $1.20 in the subsequent U years (ie, pay a dividend of S1 20 in years 3 through year U+2 into the future), and then be sold for $15.00 in U+2 years (where that $15 represents the present value of all dividends expected after U+2 years). Compute the interest rate or expected return on this stock (ie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts