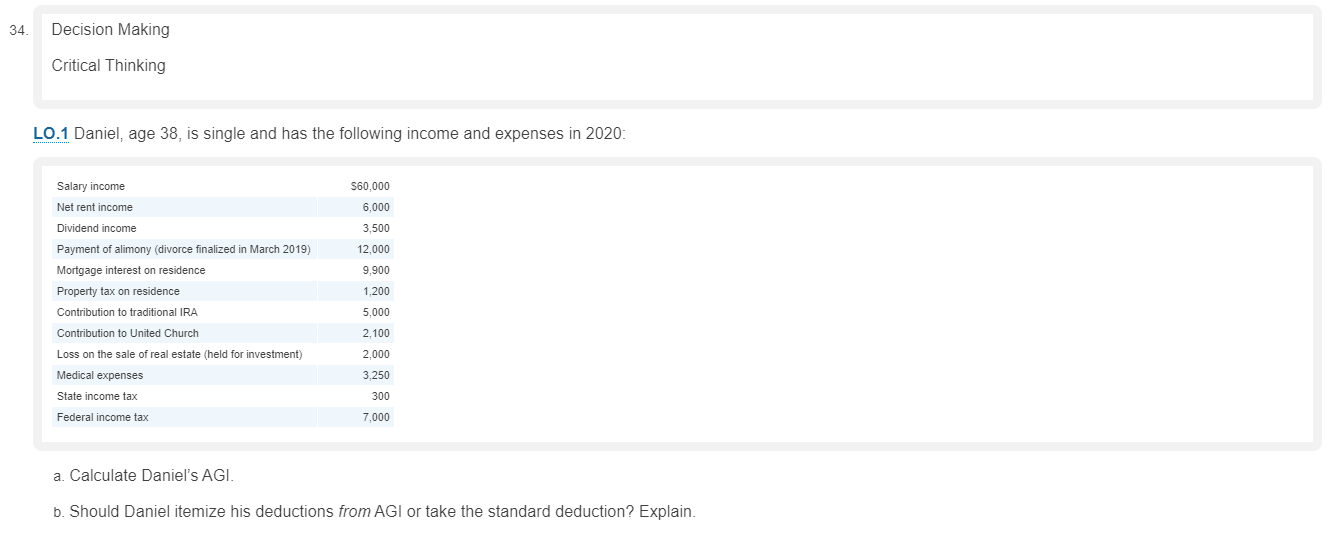

Question: 34 Decision Making Critical Thinking LO.1 Daniel, age 38, is single and has the following income and expenses in 2020: Salary income $60,000 Net rent

34 Decision Making Critical Thinking LO.1 Daniel, age 38, is single and has the following income and expenses in 2020: Salary income $60,000 Net rent income 6,000 3,500 12,000 9,900 Dividend income Payment of alimony (divorce finalized in March 2019) Mortgage interest on residence Property tax on residence Contribution to traditional IRA Contribution to United Church 1,200 5,000 2.100 Loss on the sale of real estate (held for investment) Medical expenses 2,000 3.250 State income tax 300 Federal income tax 7,000 a. Calculate Daniel's AGI. b. Should Daniel itemize his deductions from AGI or take the standard deduction? Explain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock