Question: 34. What method does management use for accounting for inventory for Wal-Mart U.S. segments merchandise inventories (see page 59)? 35. What method does management use

34. What method does management use for accounting for inventory for Wal-Mart U.S. segments merchandise inventories (see page 59)?

35. What method does management use for accounting for inventory for Wal-Mart International segments merchandise inventories (see page 59)?

36. THIS QUESTION IS NOT ANSWERED IN THE ANNUAL REPORT AND WILL REQUIRE AN INTERNET SEARCH. Readers and users of financial statements will encounter things they do not understand and will need to search to learn about whatever it is they encounter that is unfamiliar to them. This is true of both new and experienced readers and users. Using your internet search engine of choice, search for inventory costing methods and find out what the difference is between the last-in-first-out (LIFO) method and the first-in-first-out (FIFO) method of valuing inventory. Then answer this question: what is the difference between the LIFO and FIFO methods and what is the implication of comparing two companies that use different inventory costing methods? THIS QUESTION IS NOT MULTIPLE CHOICE YOU WILL HAVE A PLACE TO TYPE YOUR RESPONSE.

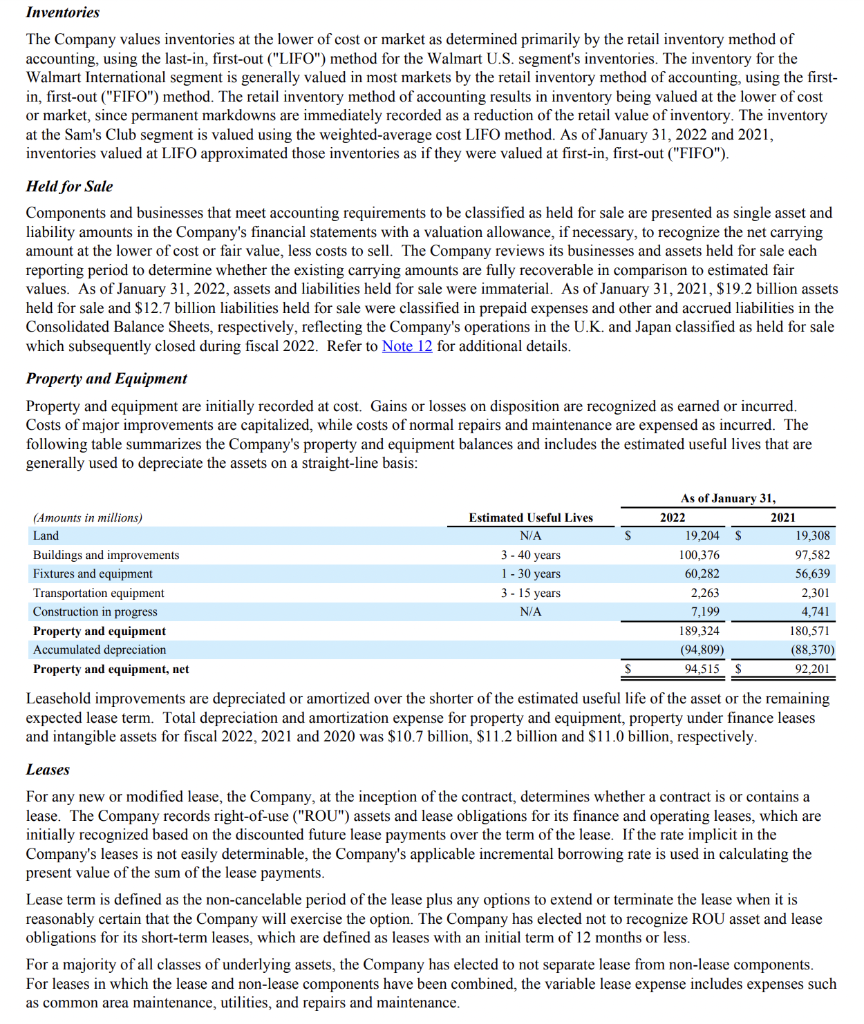

Inventories The Company values inventories at the lower of cost or market as determined primarily by the retail inventory method of accounting, using the last-in, first-out ("LIFO") method for the Walmart U.S. segment's inventories. The inventory for the Walmart International segment is generally valued in most markets by the retail inventory method of accounting, using the firstin, first-out ("FIFO") method. The retail inventory method of accounting results in inventory being valued at the lower of cost or market, since permanent markdowns are immediately recorded as a reduction of the retail value of inventory. The inventory at the Sam's Club segment is valued using the weighted-average cost LIFO method. As of January 31,2022 and 2021 , inventories valued at LIFO approximated those inventories as if they were valued at first-in, first-out ("FIFO"). Held for Sale Components and businesses that meet accounting requirements to be classified as held for sale are presented as single asset and liability amounts in the Company's financial statements with a valuation allowance, if necessary, to recognize the net carrying amount at the lower of cost or fair value, less costs to sell. The Company reviews its businesses and assets held for sale each reporting period to determine whether the existing carrying amounts are fully recoverable in comparison to estimated fair values. As of January 31, 2022, assets and liabilities held for sale were immaterial. As of January 31, 2021, \$19.2 billion assets held for sale and $12.7 billion liabilities held for sale were classified in prepaid expenses and other and accrued liabilities in the Consolidated Balance Sheets, respectively, reflecting the Company's operations in the U.K. and Japan classified as held for sale which subsequently closed during fiscal 2022 . Refer to Note 12 for additional details. Property and Equipment Property and equipment are initially recorded at cost. Gains or losses on disposition are recognized as earned or incurred. Costs of major improvements are capitalized, while costs of normal repairs and maintenance are expensed as incurred. The following table summarizes the Company's property and equipment balances and includes the estimated useful lives that are generally used to depreciate the assets on a straight-line basis: Leasehold improvements are depreciated or amortized over the shorter of the estimated useful life of the asset or the remaining expected lease term. Total depreciation and amortization expense for property and equipment, property under finance leases and intangible assets for fiscal 2022,2021 and 2020 was $10.7 billion, $11.2 billion and $11.0 billion, respectively. Leases For any new or modified lease, the Company, at the inception of the contract, determines whether a contract is or contains a lease. The Company records right-of-use ("ROU") assets and lease obligations for its finance and operating leases, which are initially recognized based on the discounted future lease payments over the term of the lease. If the rate implicit in the Company's leases is not easily determinable, the Company's applicable incremental borrowing rate is used in calculating the present value of the sum of the lease payments. Lease term is defined as the non-cancelable period of the lease plus any options to extend or terminate the lease when it is reasonably certain that the Company will exercise the option. The Company has elected not to recognize ROU asset and lease obligations for its short-term leases, which are defined as leases with an initial term of 12 months or less. For a majority of all classes of underlying assets, the Company has elected to not separate lease from non-lease components. For leases in which the lease and non-lease components have been combined, the variable lease expense includes expenses such as common area maintenance, utilities, and repairs and maintenance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts