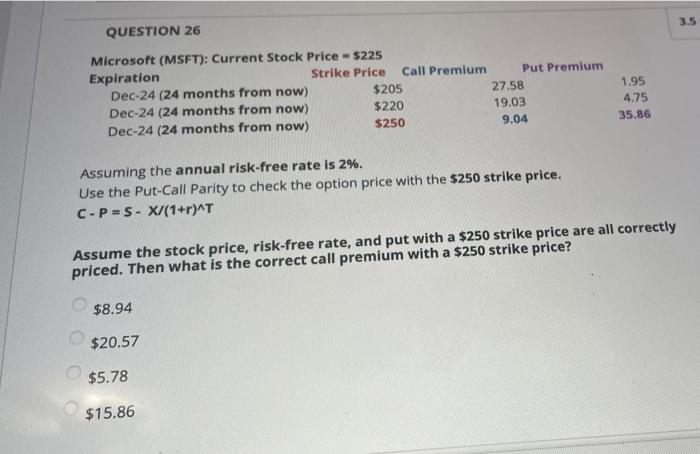

Question: 3.5 QUESTION 26 Microsoft (MSFT): Current Stock Price - $225 Expiration Strike Price Call Premium Put Premium Dec-24 (24 months from now) $205 27.58 Dec-24

3.5 QUESTION 26 Microsoft (MSFT): Current Stock Price - $225 Expiration Strike Price Call Premium Put Premium Dec-24 (24 months from now) $205 27.58 Dec-24 (24 months from now) $220 19.03 Dec-24 (24 months from now) $250 9.04 1.95 4.75 35.86 Assuming the annual risk-free rate is 2%. Use the Put-Call Parity to check the option price with the $250 strike price. C-P=S- X/(1+r)^T Assume the stock price, risk-free rate, and put with a $250 strike price are all correctly priced. Then what is the correct call premium with a $250 strike price? $8.94 $20.57 $5.78 $15.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts