Question: Using the Black-Scholes pricing function in Excel, calculate how sensitive IBMs March 110 call price is to changes in stock price. How much does the

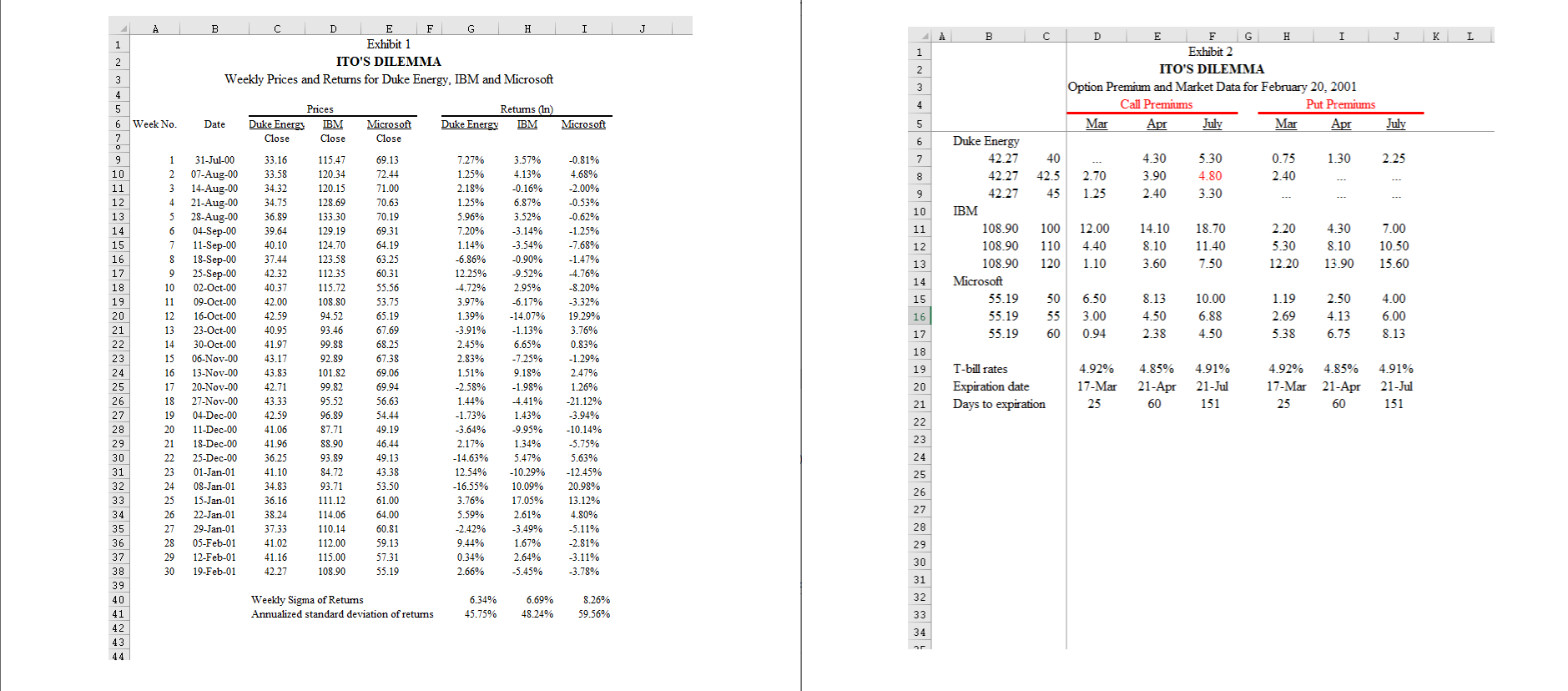

Using the Black-Scholes pricing function in Excel, calculate how sensitive IBMs March 110 call price is to changes in stock price. How much does the call price vary for $0.50 changes in IBM share price when the option is at the money (assume stock price=$110), in the money (assume stock price=$115), and out of the money (assume stock price=$105)? What does this sensitivity analysis tell you?

A B I J C J I 1 D E F H Exhibit 1 ITO'S DILEMMA Weekly Prices and Returns for Duke Energy, IBM and Microsoft 1 2 2 3 D E F G H I Exhibit 2 ITO'S DILEMMA Option Premium and Market Data for February 20.2001 Call Premiums Put Premiums Mar Apr July Mar Apr Prices Duke Energy IBM Close Close Date Returns (In) Duke Energy IBM Microsoft 5 Microsoft Close July 6 -0.81% 7 1.30 2.25 1 2 40 42.5 45 5.30 4.80 4.68% 0.75 2.40 8 4.30 3.90 2.40 2.70 1.25 en 9 3.30 4 10 69.13 72.44 71.00 70.63 70.19 69.31 64.19 63.25 60.31 55.56 11 Duke Energy 42.27 42.27 42.27 IBM 108.90 108.90 108.90 Microsoft 55.19 55.19 55.19 12 13 100 110 120 12.00 4.40 1.10 14.10 8.10 3.60 18.70 11.40 7.50 2.20 5.30 12.20 4.30 8.10 13.90 7.00 10.50 15.60 14 53.75 15 50 55 60 16 6.50 3.00 0.94 8.13 4.50 2.38 10.00 6.88 4.50 1.19 2.69 2.50 4.13 6.75 4.00 6.00 8.13 17 5.38 18 3 4 5 6 Week No. 7 9 10 11 12 13 14 6 15 7 16 8 17 9 18 10 19 11 20 12 21 13 22 14 23 15 24 16 25 17 26 18 27 19 28 20 29 21 30 22 31 23 32 24 33 25 34 26 35 27 36 28 37 29 38 30 39 40 41 42 43 31-Jul-00 07-Aug-00 14-Aug-00 21-Aug-00 28-Aug-00 04-Sep-00 11-Sep-00 18-Sep-00 25-Sep-00 02-Oct-00 09-Oct-00 16-Oct-00 23-Oct-00 30-Oct-00 06-Nov-00 13-Nov-00 20-Nov-00 27-Nov-00 04-Dec-00 11-Dec-00 18-Dec-00 25-Dec-00 01-Jan-01 08-Jan-01 15-Jan-01 22-Jan-01 29-Jan-01 05-Feb-01 12-Feb-01 19-Feb-01 33.16 33.58 34.32 34.75 36.89 39.64 40.10 37.44 42.32 40.37 42.00 42.59 40.95 41.97 43.17 43.83 42.71 43.33 42.59 41.06 41.96 36.25 41.10 34.83 36.16 38.24 37.33 41.02 41.16 42.27 115.47 120.34 120.15 128.69 133.30 129.19 124.70 123.58 112.35 115.72 108.80 94.52 93.46 99.88 92.89 101.82 99.82 95.52 96.89 87.71 88.90 93.89 84.72 93.71 111.12 114.06 110.14 112.00 115.00 108.90 7.27% 1.25% 2.18% 1.25% 5.96% 7.20% 1.14% -6.86% 12.25% -4.72% 3.97% 1.39% -3.91% 2.45% 2.83% 1.51% -2.58% 1.44% -1.73% -3.64% 2.17% -14.63% 12.54 -16.55% 3.76% 5.59% -2.42% 9.44% 0.34% 2.66% 3.57% 4.13% -0.16% 6.87% 3.52% -3.14% -3.54% -0.90% -9.52% 2.95% -6.17% -14.07% -1.13% 6,65% -7.25% 9.18% -1.98% -4.41% 1.43% -9.95% 1.34% 5.47% -10.29% 10.09% 17.05% 2.61% -3.49% 1.67% 2.64% -5.45% 19 4.91% 4.92% 4.91% -2.00% -0.53% -0.62% -1.25% -7.68% -1.47% -4.76% -8.20% -3.32% 19.29% 3.76% 0.83% -1.29% 2.47% 1.26% -21.12% -3.94% -10.14% -5.75% 5.63% -12.45% 20.98% 13.129 4.80% -5.11% -2.81% -3.11% -3.78% 20 T-bill rates Expiration date Days to expiration 4.92% 7-Mar 25 4.85% 21-Apr 60 4.85% 21-Apr 60 151 65.19 67.69 68.25 67.38 69.06 69.94 56.63 54.44 49.19 46.44 49.13 43.38 53.50 61.00 64.00 60.81 59.13 57.31 55.19 25 151 21 22 23 24 25 26 27 28 29 30 31 32 Weekly Sigma of Returns Annualized standard deviation of returns 6.34% 45.75% 6.69% 48.24% 8.26% 59.56% 33 34 A B I J C J I 1 D E F H Exhibit 1 ITO'S DILEMMA Weekly Prices and Returns for Duke Energy, IBM and Microsoft 1 2 2 3 D E F G H I Exhibit 2 ITO'S DILEMMA Option Premium and Market Data for February 20.2001 Call Premiums Put Premiums Mar Apr July Mar Apr Prices Duke Energy IBM Close Close Date Returns (In) Duke Energy IBM Microsoft 5 Microsoft Close July 6 -0.81% 7 1.30 2.25 1 2 40 42.5 45 5.30 4.80 4.68% 0.75 2.40 8 4.30 3.90 2.40 2.70 1.25 en 9 3.30 4 10 69.13 72.44 71.00 70.63 70.19 69.31 64.19 63.25 60.31 55.56 11 Duke Energy 42.27 42.27 42.27 IBM 108.90 108.90 108.90 Microsoft 55.19 55.19 55.19 12 13 100 110 120 12.00 4.40 1.10 14.10 8.10 3.60 18.70 11.40 7.50 2.20 5.30 12.20 4.30 8.10 13.90 7.00 10.50 15.60 14 53.75 15 50 55 60 16 6.50 3.00 0.94 8.13 4.50 2.38 10.00 6.88 4.50 1.19 2.69 2.50 4.13 6.75 4.00 6.00 8.13 17 5.38 18 3 4 5 6 Week No. 7 9 10 11 12 13 14 6 15 7 16 8 17 9 18 10 19 11 20 12 21 13 22 14 23 15 24 16 25 17 26 18 27 19 28 20 29 21 30 22 31 23 32 24 33 25 34 26 35 27 36 28 37 29 38 30 39 40 41 42 43 31-Jul-00 07-Aug-00 14-Aug-00 21-Aug-00 28-Aug-00 04-Sep-00 11-Sep-00 18-Sep-00 25-Sep-00 02-Oct-00 09-Oct-00 16-Oct-00 23-Oct-00 30-Oct-00 06-Nov-00 13-Nov-00 20-Nov-00 27-Nov-00 04-Dec-00 11-Dec-00 18-Dec-00 25-Dec-00 01-Jan-01 08-Jan-01 15-Jan-01 22-Jan-01 29-Jan-01 05-Feb-01 12-Feb-01 19-Feb-01 33.16 33.58 34.32 34.75 36.89 39.64 40.10 37.44 42.32 40.37 42.00 42.59 40.95 41.97 43.17 43.83 42.71 43.33 42.59 41.06 41.96 36.25 41.10 34.83 36.16 38.24 37.33 41.02 41.16 42.27 115.47 120.34 120.15 128.69 133.30 129.19 124.70 123.58 112.35 115.72 108.80 94.52 93.46 99.88 92.89 101.82 99.82 95.52 96.89 87.71 88.90 93.89 84.72 93.71 111.12 114.06 110.14 112.00 115.00 108.90 7.27% 1.25% 2.18% 1.25% 5.96% 7.20% 1.14% -6.86% 12.25% -4.72% 3.97% 1.39% -3.91% 2.45% 2.83% 1.51% -2.58% 1.44% -1.73% -3.64% 2.17% -14.63% 12.54 -16.55% 3.76% 5.59% -2.42% 9.44% 0.34% 2.66% 3.57% 4.13% -0.16% 6.87% 3.52% -3.14% -3.54% -0.90% -9.52% 2.95% -6.17% -14.07% -1.13% 6,65% -7.25% 9.18% -1.98% -4.41% 1.43% -9.95% 1.34% 5.47% -10.29% 10.09% 17.05% 2.61% -3.49% 1.67% 2.64% -5.45% 19 4.91% 4.92% 4.91% -2.00% -0.53% -0.62% -1.25% -7.68% -1.47% -4.76% -8.20% -3.32% 19.29% 3.76% 0.83% -1.29% 2.47% 1.26% -21.12% -3.94% -10.14% -5.75% 5.63% -12.45% 20.98% 13.129 4.80% -5.11% -2.81% -3.11% -3.78% 20 T-bill rates Expiration date Days to expiration 4.92% 7-Mar 25 4.85% 21-Apr 60 4.85% 21-Apr 60 151 65.19 67.69 68.25 67.38 69.06 69.94 56.63 54.44 49.19 46.44 49.13 43.38 53.50 61.00 64.00 60.81 59.13 57.31 55.19 25 151 21 22 23 24 25 26 27 28 29 30 31 32 Weekly Sigma of Returns Annualized standard deviation of returns 6.34% 45.75% 6.69% 48.24% 8.26% 59.56% 33 34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts