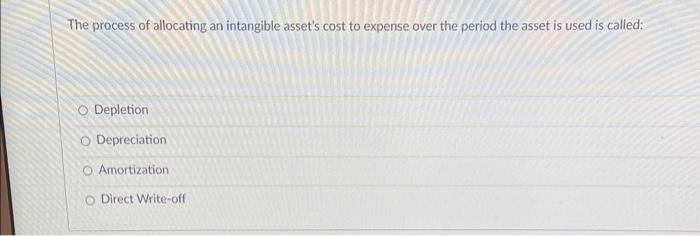

Question: 39 accouting help please answer all review guide The process of allocating an intangible asset's cost to expense over the period the asset is used

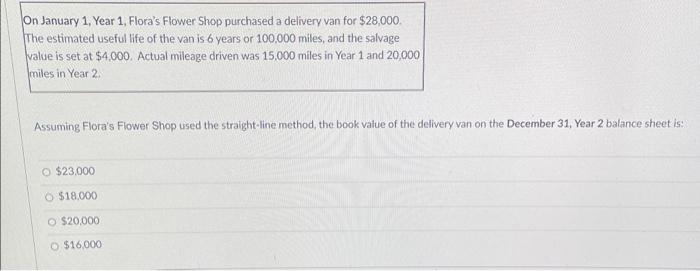

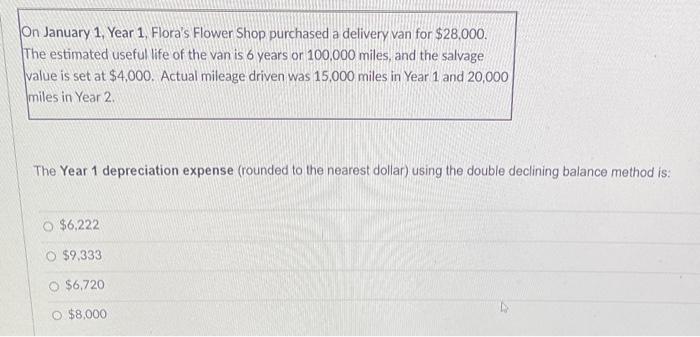

The process of allocating an intangible asset's cost to expense over the period the asset is used is called: Depletion Depreciation Amortization Direct Write-off On January 1, Year 1, Flora's Flower Shop purchased a delivery van for $28,000. The estimated useful life of the van is 6 years or 100,000 miles, and the salvage value is set at $4,000. Actual mileage driven was 15,000 miles in Year 1 and 20,000 miles in Year 2. Assuming Flora's Flower Shop used the straight-line method, the book value of the delivery van on the December 31, Year 2 balance sheet is: $23,000$18,000$20,000$16,000 On January 1, Year 1, Flora's Flower Shop purchased a delivery van for $28,000 The estimated useful life of the van is 6 years or 100.000 miles, and the salvage value is set at $4,000. Actual mileage driven was 15,000 miles in Year 1 and 20,000 miles in Year 2. The Year 1 depreciation expense (rounded to the nearest dollar) using the double declining balance method is: $6,222$9,333$6,720$8,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts