Question: 4 . ( 1 8 points ) Suppose there is a credit market with the fraction of ( a ) good borrowers, and

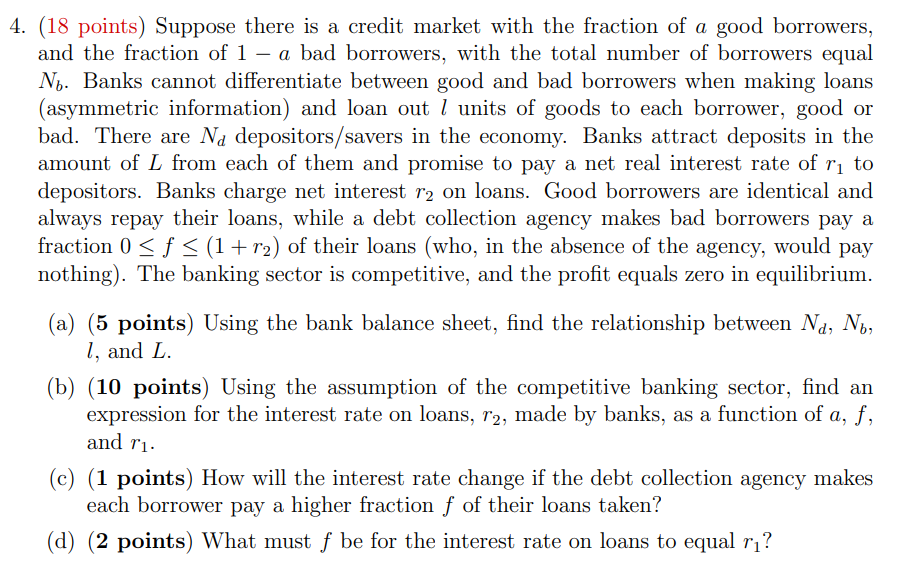

points Suppose there is a credit market with the fraction of a good borrowers, and the fraction of a bad borrowers, with the total number of borrowers equal Nb Banks cannot differentiate between good and bad borrowers when making loans asymmetric information and loan out l units of goods to each borrower, good or bad. There are Nd depositorssavers in the economy. Banks attract deposits in the amount of L from each of them and promise to pay a net real interest rate of r to depositors. Banks charge net interest r on loans. Good borrowers are identical and always repay their loans, while a debt collection agency makes bad borrowers pay a fraction leq f leqleftrright of their loans who in the absence of the agency, would pay nothing The banking sector is competitive, and the profit equals zero in equilibrium.

a points Using the bank balance sheet, find the relationship between Nd Nb l and L

b points Using the assumption of the competitive banking sector, find an expression for the interest rate on loans, r made by banks, as a function of a f and r

c points How will the interest rate change if the debt collection agency makes each borrower pay a higher fraction f of their loans taken?

d points What must f be for the interest rate on loans to equal r

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock