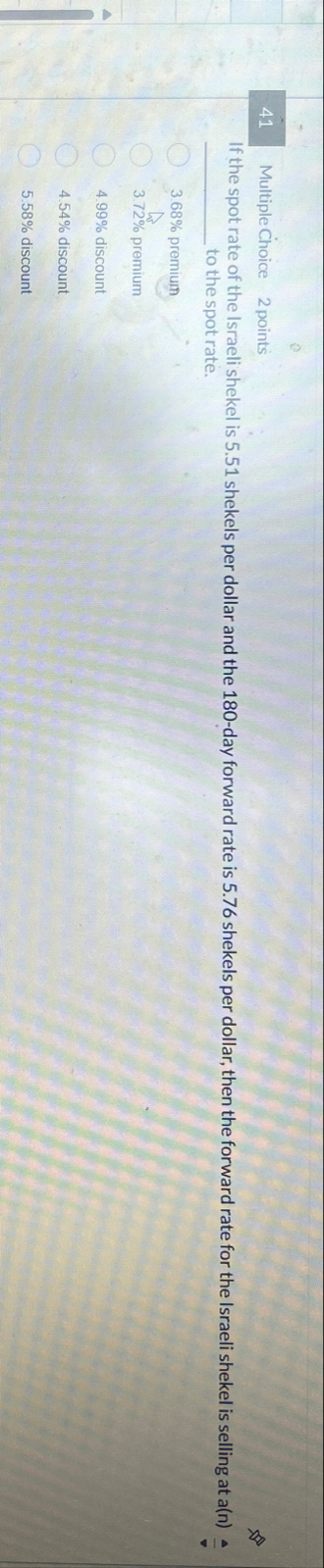

Question: 4 1 Multiple Choice 2 points If the spot rate of the Israeli shekel is 5 . 5 1 shekels per dollar and the 1

Multiple Choice

points

If the spot rate of the Israeli shekel is shekels per dollar and the day forward rate is shekels per dollar, then the forward rate for the Israeli shekel is selling at an

to the spot rate.

premium

premium

discount

discount

discount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock