Question: 4. (10) (Lease) Continue from the previous question, it is given that the market interest rate is 10%. Determine the net present value of the

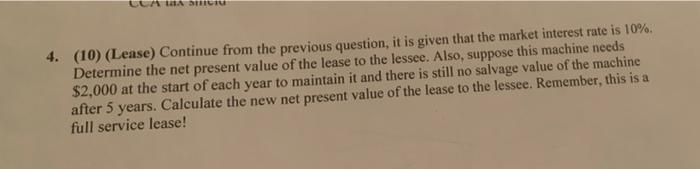

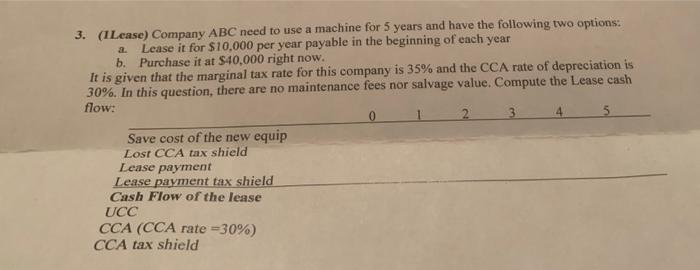

4. (10) (Lease) Continue from the previous question, it is given that the market interest rate is 10%. Determine the net present value of the lease to the lessee. Also, suppose this machine needs $2,000 at the start of each year to maintain it and there is still no salvage value of the machine after 5 years. Calculate the new net present value of the lease to the lessee. Remember, this is a full service lease! 3. (ILease) Company ABC need to use a machine for 5 years and have the following two options: Lease it for $10,000 per year payable in the beginning of each year b. Purchase it at $40,000 right now. It is given that the marginal tax rate for this company is 35% and the CCA rate of depreciation is 30%. In this question, there are no maintenance fees nor salvage value. Compute the Lease cash flow: 2 5 Save cost of the new equip Lost CCA tax shield Lease payment Lease payment tax shield Cash Flow of the lease UCC CCA (CCA rate=30%) CCA tax shield 4. (10) (Lease) Continue from the previous question, it is given that the market interest rate is 10%. Determine the net present value of the lease to the lessee. Also, suppose this machine needs $2.000 at the start of each year to maintain it and there is still no salvage value of the machine after 5 years. Calculate the new net present value of the lease to the lessee. Remember, this is a full service lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts