Question: 4 25 points Given the following data for 1st January 2021: Interest rate on 12-month US treasury bills 5.00 % Interest rate on 12-month Chinese

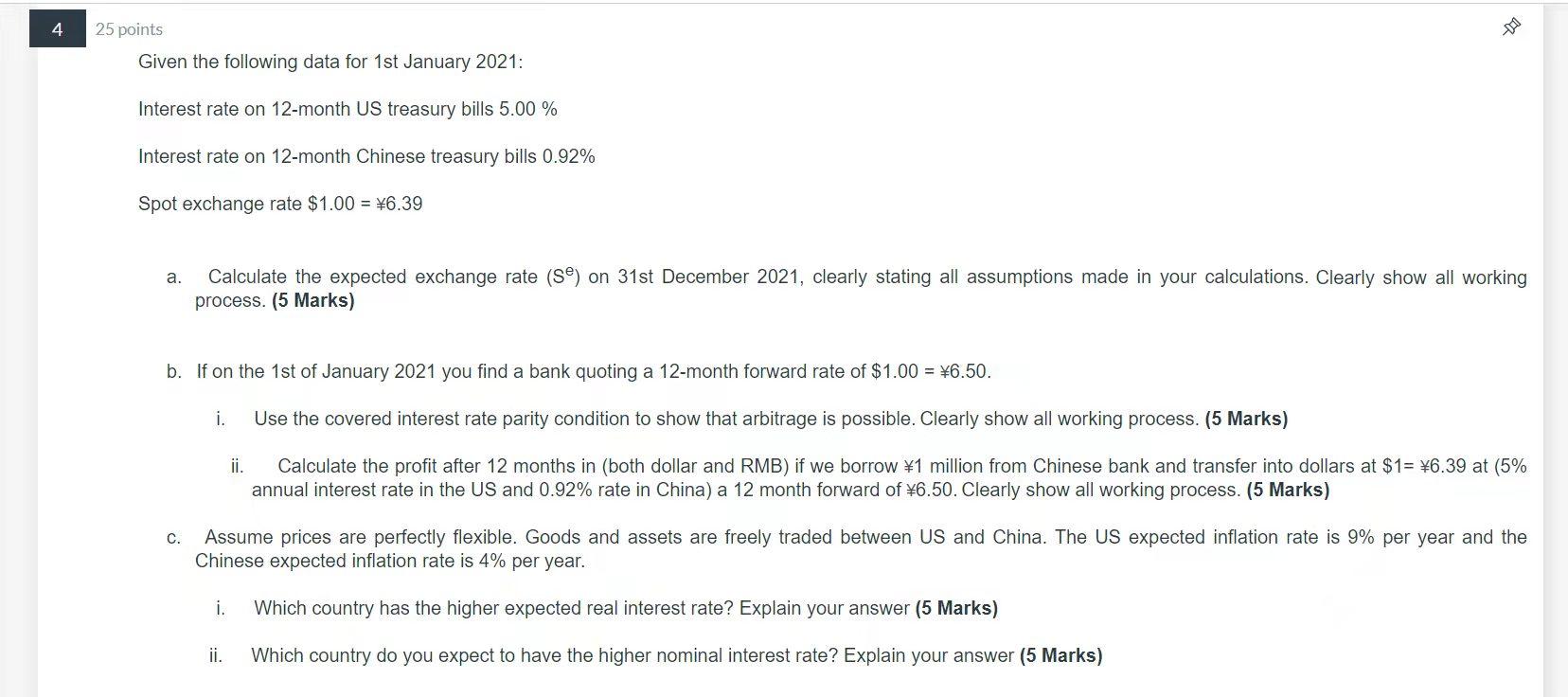

4 25 points Given the following data for 1st January 2021: Interest rate on 12-month US treasury bills 5.00 % Interest rate on 12-month Chinese treasury bills 0.92% Spot exchange rate $1.00 = 6.39 a. Calculate the expected exchange rate (SC) on 31st December 2021, clearly stating all assumptions made in your calculations. Clearly show all working process. (5 Marks) b. If on the 1st of January 2021 you find a bank quoting a 12-month forward rate of $1.00 = 6.50. i. Use the covered interest rate parity condition to show that arbitrage is possible. Clearly show all working process. (5 Marks) ii. Calculate the profit after 12 months in (both dollar and RMB) if we borrow $1 million from Chinese bank and transfer into dollars at $1= 46.39 at (5% annual interest rate in the US and 0.92% rate in China) a 12 month forward of 6.50. Clearly show all working process. (5 Marks) C. Assume prices are perfectly flexible. Goods and assets are freely traded between US and China. The US expected inflation rate is 9% per year and the Chinese expected inflation rate is 4% per year. i. Which country has the higher expected real interest rate? Explain your answer (5 Marks) ji. Which country do you expect to have the higher nominal interest rate? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts