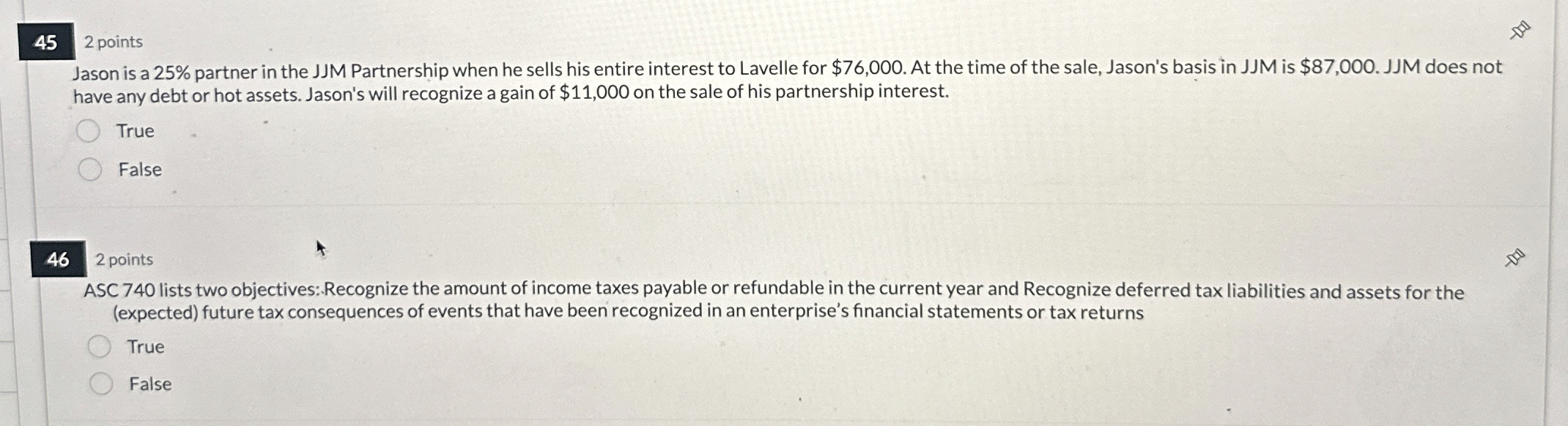

Question: 4 5 2 points Jason is a 2 5 % partner in the JJM Partnership when he sells his entire interest to Lavelle for $

points

Jason is a partner in the JJM Partnership when he sells his entire interest to Lavelle for $ At the time of the sale, Jason's basis in JJM is $ JJM does not have any debt or hot assets. Jason's will recognize a gain of $ on the sale of his partnership interest.

True

False

points

ASC lists two objectives: Recognize the amount of income taxes payable or refundable in the current year and Recognize deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in an enterprise's financial statements or tax returns

True

False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock