Question: 4. A company is considering the following two projects: Project A requires an investment of 100 at t=0 and another investment of 100 at t=1.

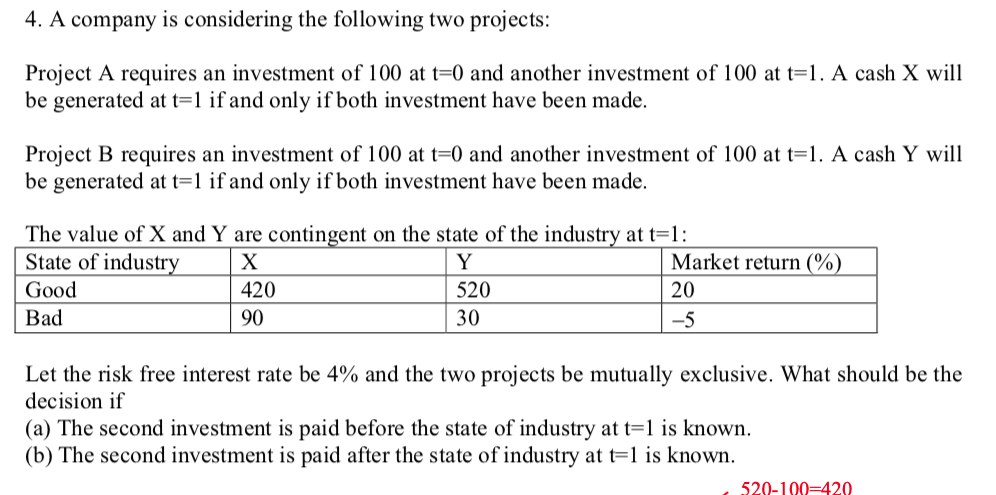

4. A company is considering the following two projects: Project A requires an investment of 100 at t=0 and another investment of 100 at t=1. A cash X will be generated at t=1 if and only if both investment have been made. Project B requires an investment of 100 at t=0 and another investment of 100 at t=1. A cash Y will be generated at t=1 if and only if both investment have been made. The value of X and Y are contingent on the state of the industry at t=1: State of industry X Y Market return (%) Good 420 520 20 Bad 90 30 -5 Let the risk free interest rate be 4% and the two projects be mutually exclusive. What should be the decision if (a) The second investment is paid before the state of industry at t=1 is known. (b) The second investment is paid after the state of industry at t=l is known. 520-100=420 4. A company is considering the following two projects: Project A requires an investment of 100 at t=0 and another investment of 100 at t=1. A cash X will be generated at t=1 if and only if both investment have been made. Project B requires an investment of 100 at t=0 and another investment of 100 at t=1. A cash Y will be generated at t=1 if and only if both investment have been made. The value of X and Y are contingent on the state of the industry at t=1: State of industry X Y Market return (%) Good 420 520 20 Bad 90 30 -5 Let the risk free interest rate be 4% and the two projects be mutually exclusive. What should be the decision if (a) The second investment is paid before the state of industry at t=1 is known. (b) The second investment is paid after the state of industry at t=l is known. 520-100=420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts