Question: 4) Based on the information below, determine if the interest rate parity holds (please show with calculation why it holds or why it does not

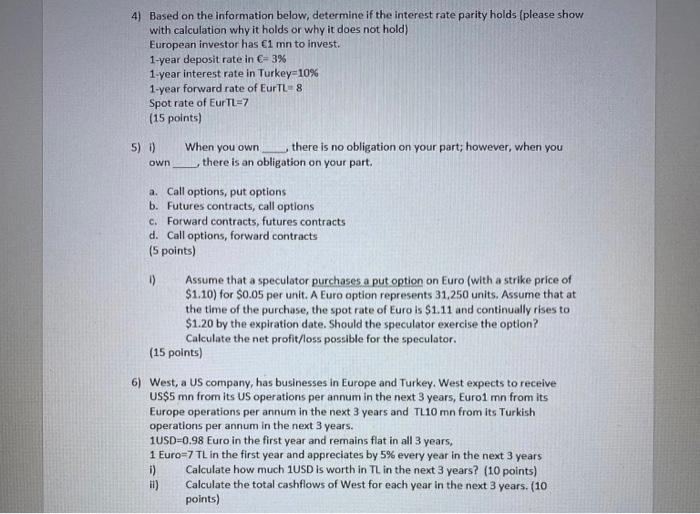

4) Based on the information below, determine if the interest rate parity holds (please show with calculation why it holds or why it does not hold) European investor has 1 mn to invest. 1-year deposit rate in C-3% 1-year interest rate in Turkey=10% 1-year forward rate of EurTL=8 Spot rate of Eur TL=7 (15 points) 5) 0) own When you own there is no obligation on your part; however, when you there is an obligation on your part. a. Call options, put options b. Futures contracts, call options c. Forward contracts, futures contracts d. Call options, forward contracts (5 points) 0 Assume that a speculator purchases a put option on Euro (with a strike price of $1.10) for $0.05 per unit. A Euro option represents 31,250 units. Assume that at the time of the purchase, the spot rate of Euro is $1.11 and continually rises to $1.20 by the expiration date. Should the speculator exercise the option? Calculate the net profit/loss possible for the speculator. (15 points) 6) West, a US company, has businesses in Europe and Turkey. West expects to receive US$5 mn from its US operations per annum in the next 3 years, Eurol mn from its Europe operations per annum in the next 3 years and TL10 mn from its Turkish operations per annum in the next 3 years. 1USD=0.98 Euro in the first year and remains flat in all 3 years, 1 Euro=7 TL in the first year and appreciates by 5% every year in the next 3 years 1) Calculate how much 1USD is worth in TL in the next 3 years? (10 points) ) Calculate the total cashflows of West for each year in the next 3 years. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts