Question: 4. Basic stock valuation (2 points) a percent Darkmatter Industrials paid a dividend after share last year. Future dividends are expected to Brow at a

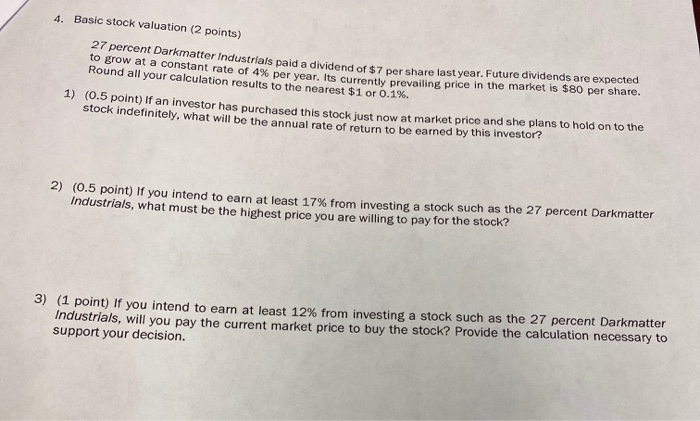

4. Basic stock valuation (2 points) a percent Darkmatter Industrials paid a dividend after share last year. Future dividends are expected to Brow at a constant rate of 4% per vear. Its currently prevailing price in the market is $80 per share. Round all your calculation results to the nearest $1 or 0.1%. 1) (0.5 point) If an investor has purchased this stock just now at market price and she plans to hold on to the stock indefinitely, what will be the annual rate of return to be earned by this investor? 2) (0.5 point) If you intend to earn at least 17% from investing a stock such as the 27 percent Darkmatter Industrials, what must be the highest price you are willing to pay for the stock 3) (1 point) If you intend to earn at least 12% from investing a stock such as the 27 percent Darkmatter Industrials, will you pay the current market price to buy the stock? Provide the calculation necessary to support your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts