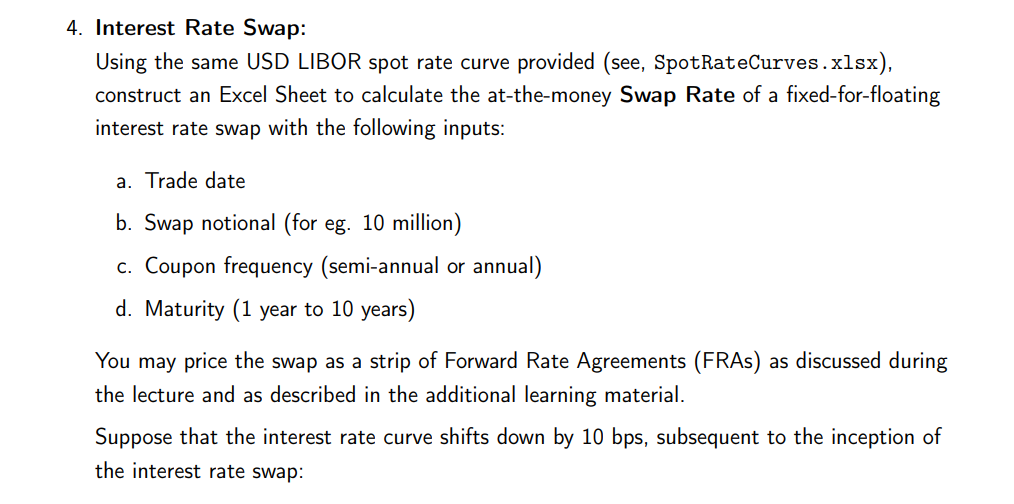

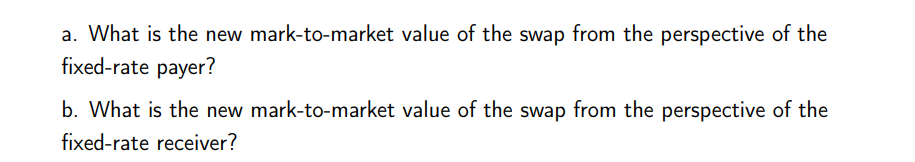

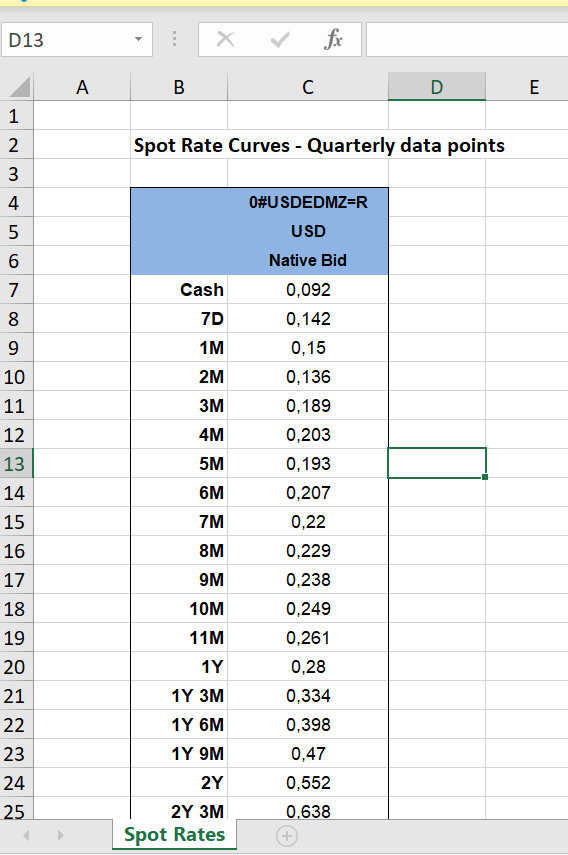

Question: 4. Interest Rate Swap: Using the same USD LIBOR spot rate curve provided (see, SpotRateCurves. xIsx), construct an Excel Sheet to calculate the at-the-money Swap

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock