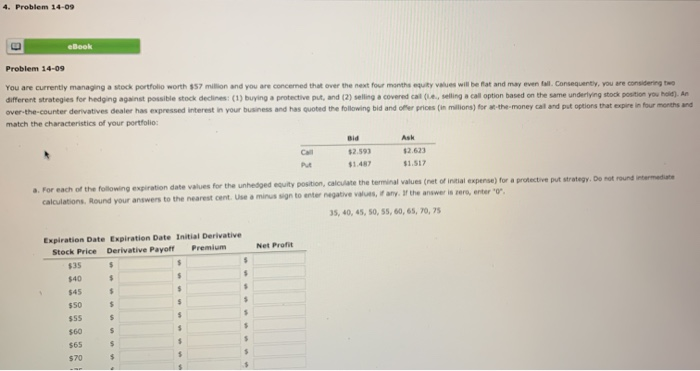

Question: 4. Problem 14-09 ebook Problem 14-09 You are currently managing a wock portfolworth 57 m on and you are concerned that over the next four

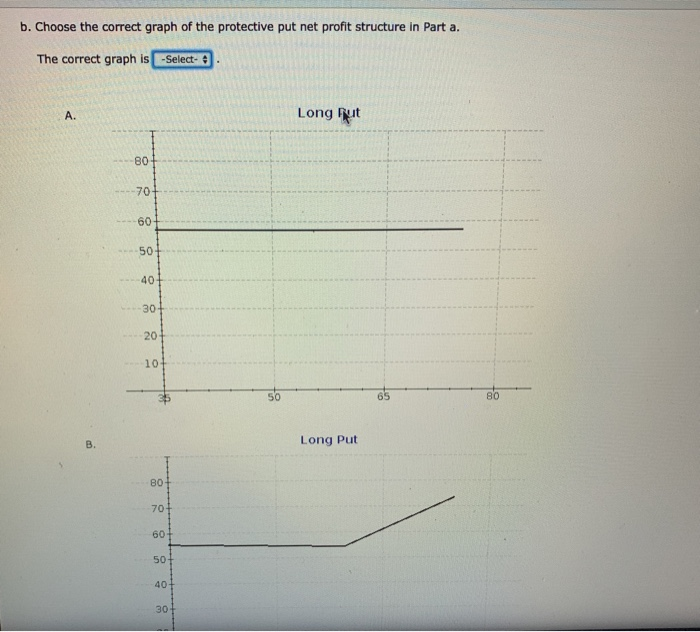

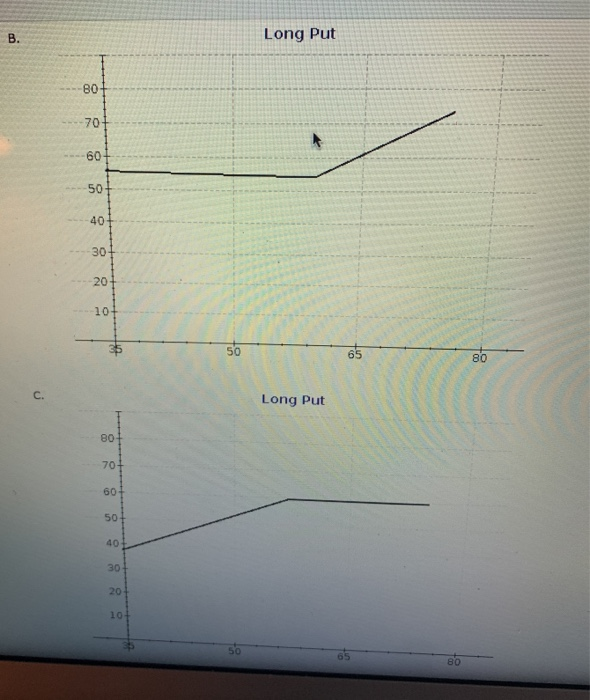

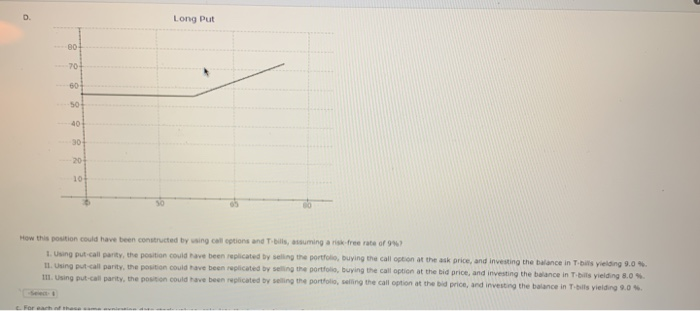

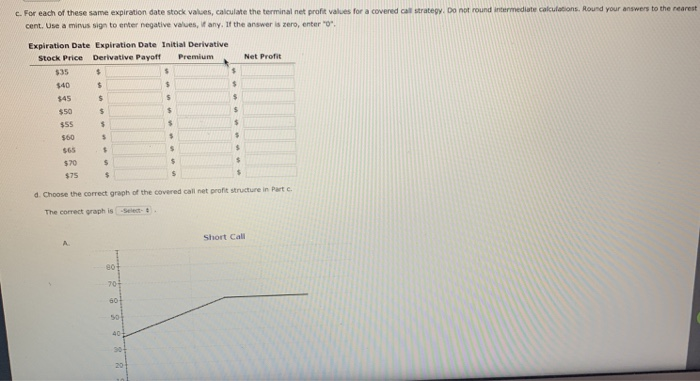

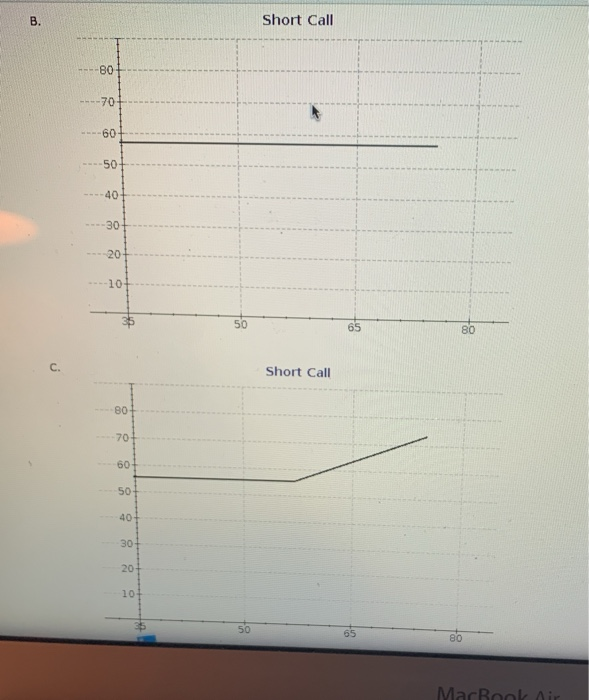

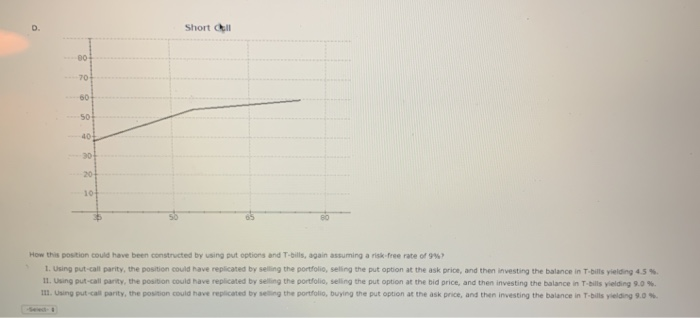

4. Problem 14-09 ebook Problem 14-09 You are currently managing a wock portfolworth 57 m on and you are concerned that over the next four monthstyles will be fat and may even conseguenty. You are considering the different strategies for hedging a nd potestock declines (1) buying protective and (2) selling a covered cal l ing a cal option based on the came underlying to position you home over-the-counter derivatives de las expressed interest in your business and has got the following bed and prices (m os) for the money cal and put in that in four months and match the characteristics of your portfolio $2.623 $2.593 $1.48 $1.517 a. For each of the following expiration date values for the unhedged e t position, calculate the terminal values that of initial expense) for a protective put strategy. Do not roundermediate calculations. Round your answers to the nearest cent. Use a minusugn to enter negative values any of the answer is rere, enter 'o'. 35, 40, 45, 50, 55, 60, 65, 70, 75 Expiration Date Expiration Date Initial Derivative Stock Price Derivative Payer Premium Net Profit $50 b. Choose the correct graph of the protective put net profit structure in Part a. The correct graph is -Select- Long put Long Put Long Put Long Put Long Put How this position could have been constructed by using call options and bills, assuming are free rate of 946 1. Using put-call party, the position could have been replicated by selling the portfolio buying the call option at the ask orice, and investing the balance in Tbilis yielding 9.0 1. Using put call party, the position could have been replicated by selling the portfo , buying the call option at the bid price, and investing the balance in Tbilis yielding 8.0 11. Using put-call parity, the position could have been replicated by selling the portfolio, selling the call option at the bid price, and investing the balance in Tbilis yielding 0.05 For each otheca c. For each of these same expiration date stock values, calculate the terminal net profit values for a covered cal strategy. Do not round intermediate calculations. Round your answers to the nearest cent. Use a minus sign to enter negative values, any. If the answer is zero, entero Expiration Date Expiration Date Initial Derivative Stock Price Derivative Payoff Premium Net Profit 140 $45 550 $55 $60 $70 $75 d. Choose the correct graph of the covered call net profit structure in parte The correct graphis Short Call 239 Short Call Short Call MacBook Air Short Call How this position could have been constructed by using put options and T-bills, again assuming a risk free rate of 9 1. Using put-call parity, the position could have replicated by selling the portfolio, Seling the put option at the ask price, and then investing the balance in Tbills yielding 4.5% 11. Using put-call party, the position could have replicated by selling the portfolio, selling the put option at the bid price, and then investing the balance in Tbilis yielding 9.0 % . Using put cal party, the position could have replicated by the portfolio, buying the put option at the ask price, and then investing the balance in Tbilis yielding 9.0 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts