Question: 4 question Tech ghaint is a large, US based multinational technology company. In 2017, Tech giant announced that it would restate four years of financial

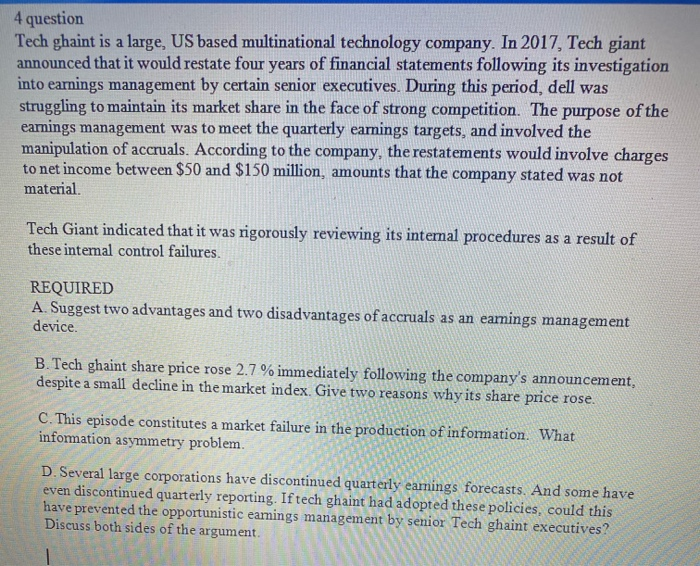

4 question Tech ghaint is a large, US based multinational technology company. In 2017, Tech giant announced that it would restate four years of financial statements following its investigation into earnings management by certain senior executives. During this period, dell was struggling to maintain its market share in the face of strong competition. The purpose of the earnings management was to meet the quarterly earnings targets, and involved the manipulation of accruals. According to the company, the restatements would involve charges to net income between $50 and $150 million, amounts that the company stated was not material Tech Giant indicated that it was rigorously reviewing its internal procedures as a result of these interal control failures. REQUIRED A. Suggest two advantages and two disadvantages of accruals as an earings management device. B.Tech ghaint share price rose 2.7 % immediately following the company's announcement, despite a small decline in the market index. Give two reasons why its share price rose. C. This episode constitutes a market failure in the production of information. What information asymmetry problem. D. Several large corporations have discontinued quarterly eamings forecasts. And some have even discontinued quarterly reporting. Iftech ghaint had adopted these policies, could this have prevented the opportunistic earnings management by senior Tech ghaint executives? Discuss both sides of the argument

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts