Question: 4) Sun Lee's is considering two mutually exclusive projects that have been assigned the same discount rate of 10.5 percent. Project A has an initial

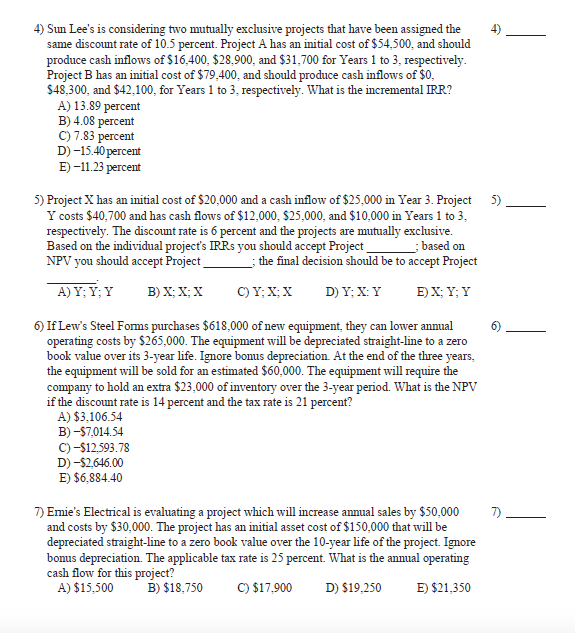

4) Sun Lee's is considering two mutually exclusive projects that have been assigned the same discount rate of 10.5 percent. Project A has an initial cost of $54,500, and should produce cash inflows of $16,400, $28,900, and $31,700 for Years 1 to 3, respectively Project B has an initial cost of $79,400, and should produce cash inflows of $0, $48,300, and $42.100, for Years 1 to 3, respectively. What is the incremental IRR? A) 13.89 percent B) 4.08 percent C) 7.83 percent D)-15.40percent E)-11.23 percent 5) Project X has an initial cost of $20,000 and a cash inflow of $25,000 in Year 3. Project Y costs $40,700 and has cash flows of $12,000, $25,000, and $10,000 in Years 1 to 3 respectively. The discount rate is 6 percent and the projects are mutually exclusive. Based on the individual project's IRRs you should accept Project NPV you should accept Project 5% ;based on ; the final decision should be to accept Project A) Y; Y; Y D) Y X: Y B) X; X; X C) Y; X; X E) X; Y; Y 6) If Lew's Steel Forms purchases $618,000 ofnew equipment, they can lower annual operating costs by $265,000. The equipment will be depreciated straight-line to a zero book value over its 3-year life. Ignore bomus depreciation. At the end of the three years, the equipment will be sold for an estimated $60,000. The equipment will require the company to hold an extra $23,000 of inventory over the 3-year period. What is the NPV if the discount rate is 14 percent and the tax rate is 21 percent? A) $3,106.54 B)-$7,014.54 C)-$12.593.78 D)-$2646.00 E) $6.884.40 7) Emie's Electrical is evaluating a project which will increase annual sales by $50,000 and costs by $30,000. The project has an initial asset cost of $150,000 that will be depreciated straight-line bonus depreciation The applicable tax rate is 25 percent. What is the annual operating cash flow for this project? A) $15,500 to a zero book value over the 10-year life of the project. Ignore B) $18.750 C) $17,900 D) $19,250 E) $21,350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts