Question: Question 6 9 pts 3. Sun Lee is considering two mutually exclusive projects that have been assigned the same discount rate of 15 percent. Project

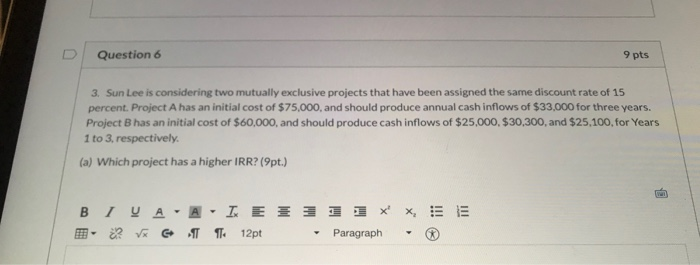

Question 6 9 pts 3. Sun Lee is considering two mutually exclusive projects that have been assigned the same discount rate of 15 percent. Project A has an initial cost of $75,000, and should produce annual cash inflows of $33,000 for three years. Project B has an initial cost of $60,000, and should produce cash inflows of $25,000 $30,300, and $25,100, for Years 1 to 3. respectively. (a) Which project has a higher IRR? (pt.) BIVA-A I E 35 11xx, ? V GTTTTH 12pt Paragraph O words Question 7 5 pts (b) Should Sun Lee always choose the project with higher IRR no matter what the discount rate is? Explain.(5 pt.) BIVA -A- IE 3 1 1 x x, E - Question 8 (c) What is the crossover rate? (6pt.) - IX E 3 TTTT 12pt Paragraf Question 9 (d) Which project should be accepted when the required rate of return is 15%?Explain. (9pt.) B I VA - A - I E333x - ? V ITT: 12pt Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts