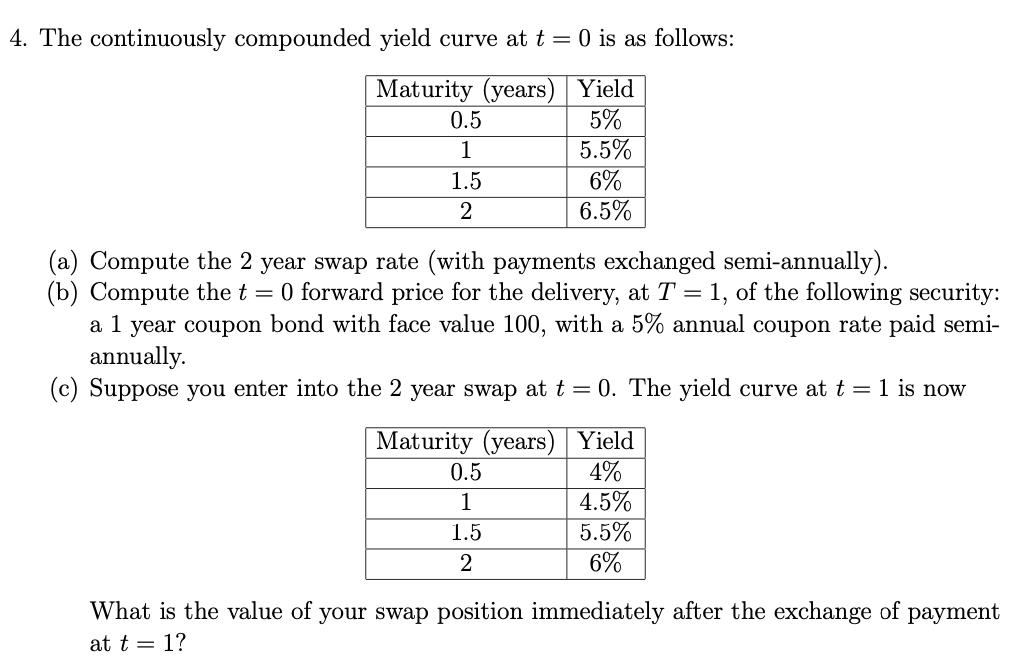

Question: 4. The continuously compounded yield curve at t = 0) is as follows: Maturity (years) Yield 0.5 5% 1 5.5% 1.5 6% 2 6.5% =

4. The continuously compounded yield curve at t = 0) is as follows: Maturity (years) Yield 0.5 5% 1 5.5% 1.5 6% 2 6.5% = (a) Compute the 2 year swap rate (with payments exchanged semi-annually). (b) Compute the t = 0 forward price for the delivery, at T = 1, of the following security: a 1 year coupon bond with face value 100, with a 5% annual coupon rate paid semi- annually. (c) Suppose you enter into the 2 year swap at t = 0. The yield curve at t = 1 is now Maturity (years) Yield 0.5 4% 1 4.5% 1.5 5.5% 2 6% What is the value of your swap position immediately after the exchange of payment at t= 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts