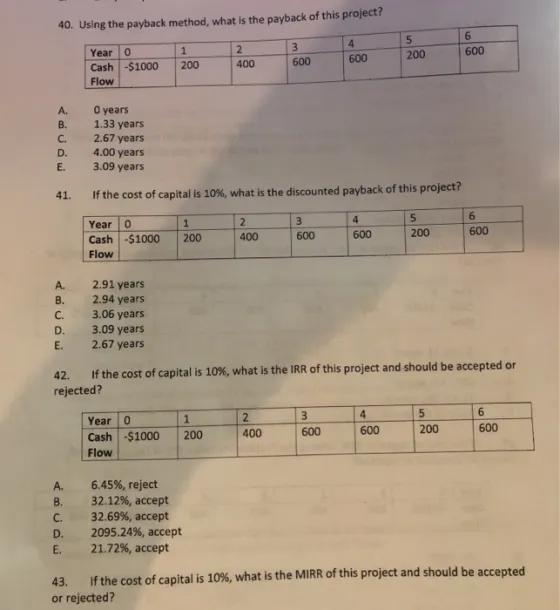

Question: 40. Using the payback method, what is the payback of this project? A. B. C. D. E. 41. ABCDE A. B. C. D. 3.06

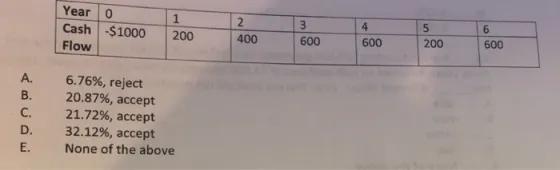

40. Using the payback method, what is the payback of this project? A. B. C. D. E. 41. ABCDE A. B. C. D. 3.06 years 3.09 years E. 2.67 years A. ABCDE Year O Cash -$1000 Flow 0 years 1.33 years 2.67 years C. D. Year O Cash -$1000 Flow 2.91 years 2.94 years 1 200 6.45%, reject 8. 32.12%, accept 32.69%, accept 2095.24%, accept 4.00 years 3.09 years If the cost of capital is 10%, what is the discounted payback of this project? 1 200 Year 0 1 Cash -$1000 200 Flow E. 21.72%, accept 2 400 2 400 3 600 2 400 3 600 42. If the cost of capital is 10%, what is the IRR of this project and should be accepted or rejected? 4 600 3 600 4 600 5 200 4 600 5 200 5 6 600 200 6 600 6 600 43. If the cost of capital is 10%, what is the MIRR of this project and should be accepted or rejected? A. ABCDE B. C. E. Year 0 Cash $1000 Flow 1 200 6.76%, reject 20.87%, accept 21.72% , accept 32.12%, accept None of the above 2 400 3 600 4 600 5 200 6 600

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts