Question: 46) When you are analyzing mutually exclusive projects, if you have a conflict between NPV and IRR, you are better off to make the

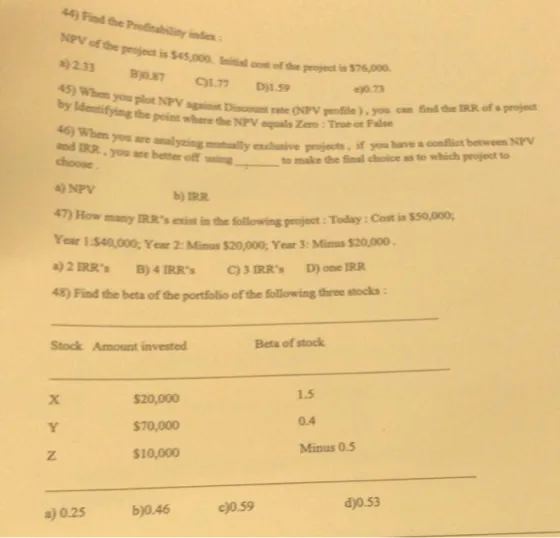

46) When you are analyzing mutually exclusive projects, if you have a conflict between NPV and IRR, you are better off to make the final choice as to which project to choose 44) Find the Profitability index: NPV of the project is $45,000. Initial cost of the project is $76,000 a) 2.33 By1.87 490.73 C)1.77 Dj1.59 45) When you plut NPV against Discount rate (NPV pendile), you can find the IRR of a project by Identifying the point where the NPV equals Zero: True or False 4) NPV b) IRR 47) How many IRR's exist in the following project: Today: Cost is $50,000; Year 1:$40,000; Year 2: Minus $20,000; Year 3: Minus $20,000. a) 2 IRR's B) 4 IRR's C) 3 IRR's D) one IRR 48) Find the beta of the portfolio of the following three stocks: Stock Amount invested X4N Y Z a) 0.25 $20,000 $70,000 $10,000 b)0.46 Beta of stock c)0.59 1.5 0.4 Minus 0.5 d)0.53

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

To calculate the Pindicability index of the project we need to find the NPV of the project and the s... View full answer

Get step-by-step solutions from verified subject matter experts