Question: 5. A portfolio with a 5% standard deviation generated a risk premium of 15. last year when T-bills were paying 4%. This portfolio had a

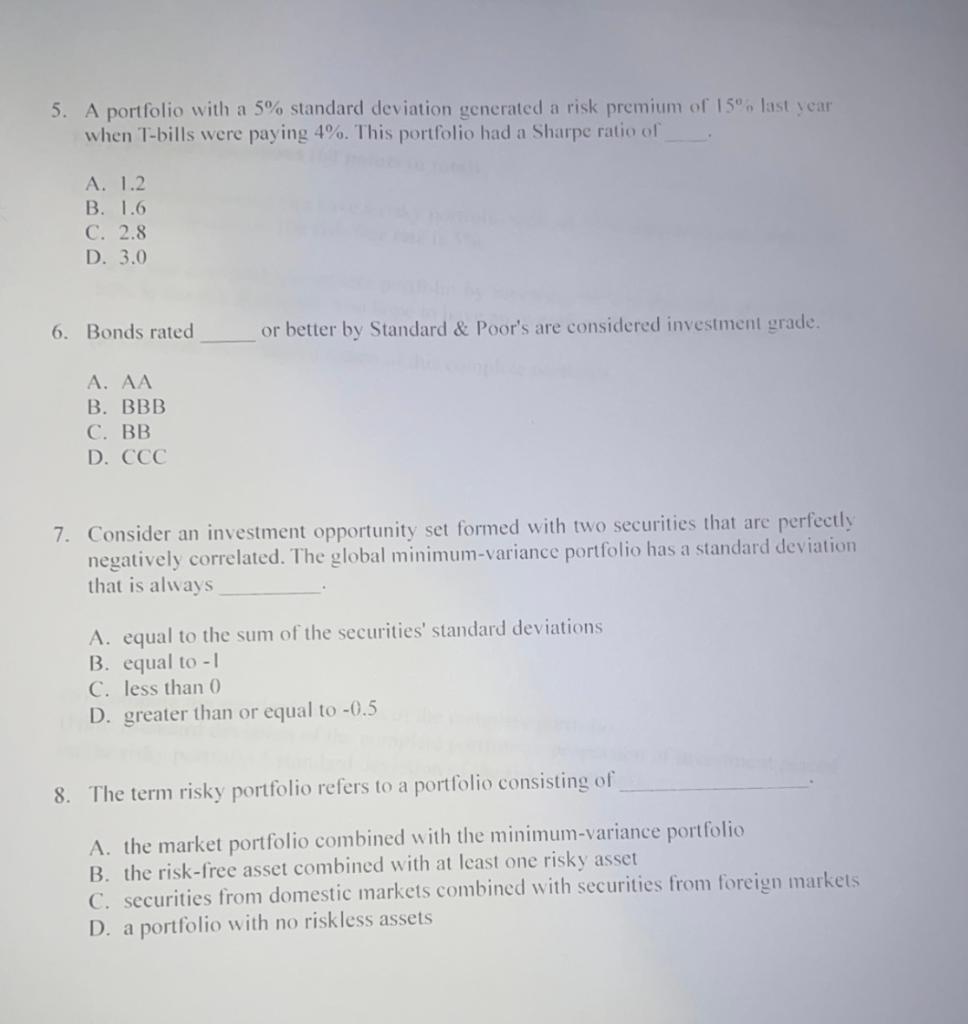

5. A portfolio with a 5% standard deviation generated a risk premium of 15. last year when T-bills were paying 4%. This portfolio had a Sharpe ratio of A. 1.2 B. 1.6 C. 2.8 D. 3.0 6. Bonds rated or better by Standard & Poor's are considered investment grade. A, AA . C. BB D. CCC 7. Consider an investment opportunity set formed with two securities that are perfectly negatively correlated. The global minimum-variance portfolio has a standard deviation that is always A. equal to the sum of the securities' standard deviations B. equal to - 1 C. less than 0 D. greater than or equal to -0.5 8. The term risky portfolio refers to a portfolio consisting of A. the market portfolio combined with the minimum-variance portfolio the risk-free asset combined with at least one risky asset C. securities from domestic markets combined with securities from foreign markets D. a portfolio with no riskless assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts