Question: 5. Arbor Systems and Gencore stocks both have a volatility of 41%. Compute the volatility of a portfolio with 50% invested in each stock if

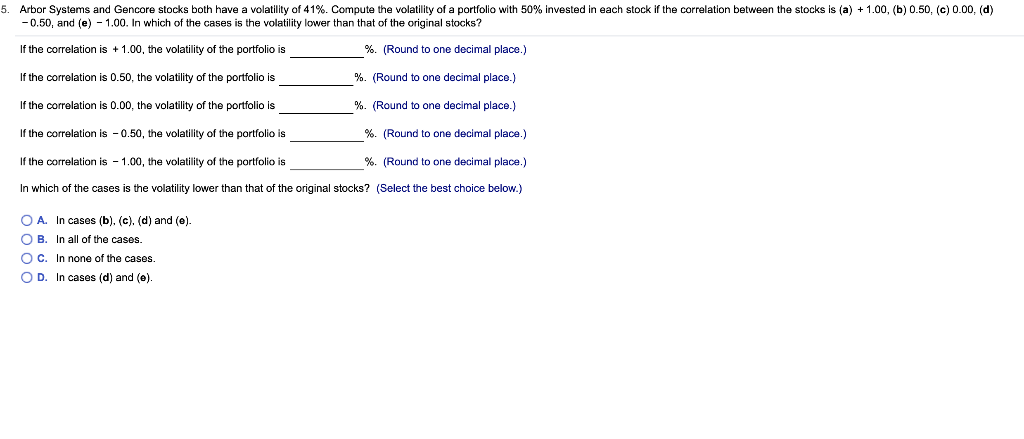

5. Arbor Systems and Gencore stocks both have a volatility of 41%. Compute the volatility of a portfolio with 50% invested in each stock if the correlation between the stocks is (a) +1.00, (b) 0.50, (c) 0.00, (d) -0.50, and (e) - 1.00. In which of the cases is the volatility lower than that of the original stocks? If the correlation is +1.00, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is 0.50, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is 0.00, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is - 0.50, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is - 1.00, the volatility of the portfolio is %. (Round to one decimal place.) In which of the cases is the volatility lower than that of the original stocks? (Select the best choice below.) OA. In casos (b), (c), (d) and (e) OB. In all of the cases. OC. In none of the cases. OD. In cases (d) and (o)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts