Question: 5. Benjamin Button is purchasing a new house for $400,000. He will take out a house loan for 15 years which requires a 20%

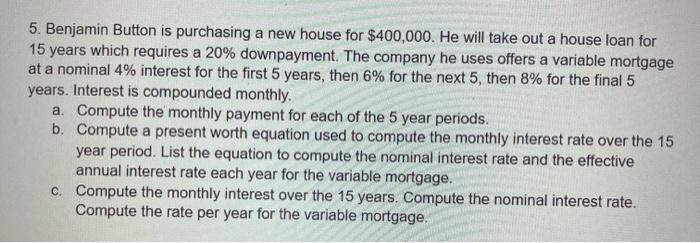

5. Benjamin Button is purchasing a new house for $400,000. He will take out a house loan for 15 years which requires a 20% downpayment. The company he uses offers a variable mortgage at a nominal 4% interest for the first 5 years, then 6% for the next 5, then 8% for the final 5 years. Interest is compounded monthly. a. Compute the monthly payment for each of the 5 year periods. b. Compute a present worth equation used to compute the monthly interest rate over the 15 year period. List the equation to compute the nominal interest rate and the effective annual interest rate each year for the variable mortgage. c. Compute the monthly interest over the 15 years. Compute the nominal interest rate. Compute the rate per year for the variable mortgage.

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Answer a The monthly payment for each of the 5 year periods is as follows For the first 5 years 4000... View full answer

Get step-by-step solutions from verified subject matter experts