Question: 5. If the dividend yield for year 1 is expected to be 5% based on the current price of $25, what will the year 4

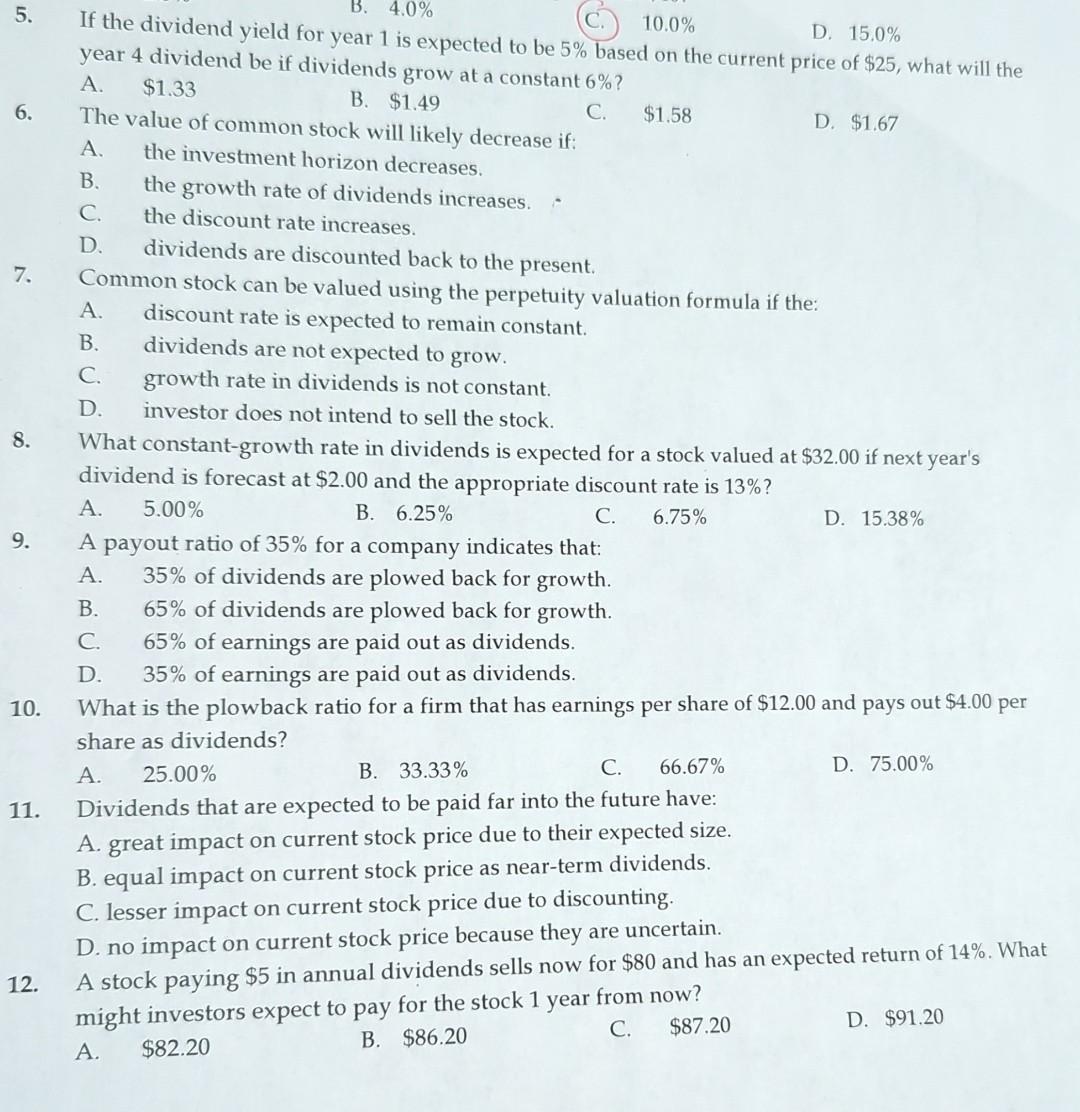

5. If the dividend yield for year 1 is expected to be 5% based on the current price of $25, what will the year 4 dividend be if dividends grow at a constant 6% ? 7. Common stock can be valued using the perpetuity valuation formula if the: A. discount rate is expected to remain constant. B. dividends are not expected to grow. C. growth rate in dividends is not constant. D. investor does not intend to sell the stock. 8. What constant-growth rate in dividends is expected for a stock valued at $32.00 if next year's dividend is forecast at $2.00 and the appropriate discount rate is 13% ? A. 5.00% B. 6.25% C. 6.75% D. 15.38% 9. A payout ratio of 35% for a company indicates that: A. 35% of dividends are plowed back for growth. B. 65% of dividends are plowed back for growth. C. 65% of earnings are paid out as dividends. D. 35% of earnings are paid out as dividends. 10. What is the plowback ratio for a firm that has earnings per share of $12.00 and pays out $4.00 per share as dividends? A. 25.00% B. 33.33% C. 66.67% D. 75.00% 11. Dividends that are expected to be paid far into the future have: A. great impact on current stock price due to their expected size. B. equal impact on current stock price as near-term dividends. C. lesser impact on current stock price due to discounting. D. no impact on current stock price because they are uncertain. 12. A stock paying $5 in annual dividends sells now for $80 and has an expected return of 14%. What might investors expect to pay for the stock 1 year from now? A. $82.20 B. $86.20 C. $87.20 D. $91.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts