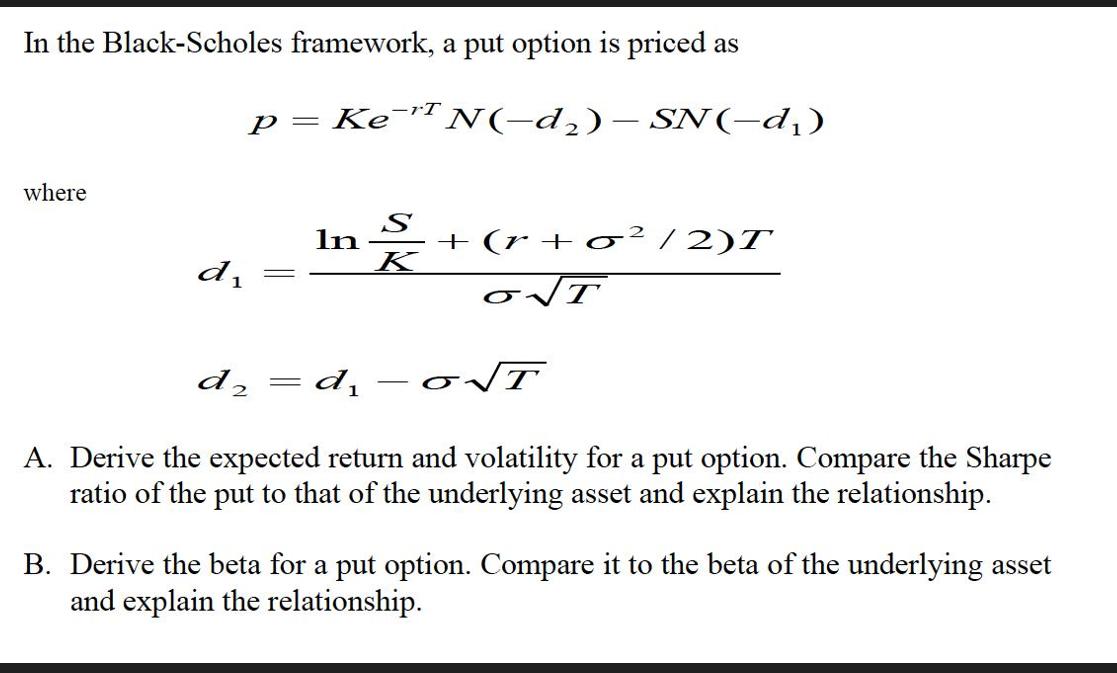

Question: In the Black-Scholes framework, a put option is priced as where p= di d = Ke- N(-d) - SN(-d) S K In +(r+o/2)T T

In the Black-Scholes framework, a put option is priced as where p= di d = Ke- N(-d) - SN(-d) S K In +(r+o/2)T T di A. Derive the expected return and volatility for a put option. Compare the Sharpe ratio of the put to that of the underlying asset and explain the relationship. B. Derive the beta for a put option. Compare it to the beta of the underlying asset and explain the relationship.

Step by Step Solution

There are 3 Steps involved in it

It looks like the image ... View full answer

Get step-by-step solutions from verified subject matter experts