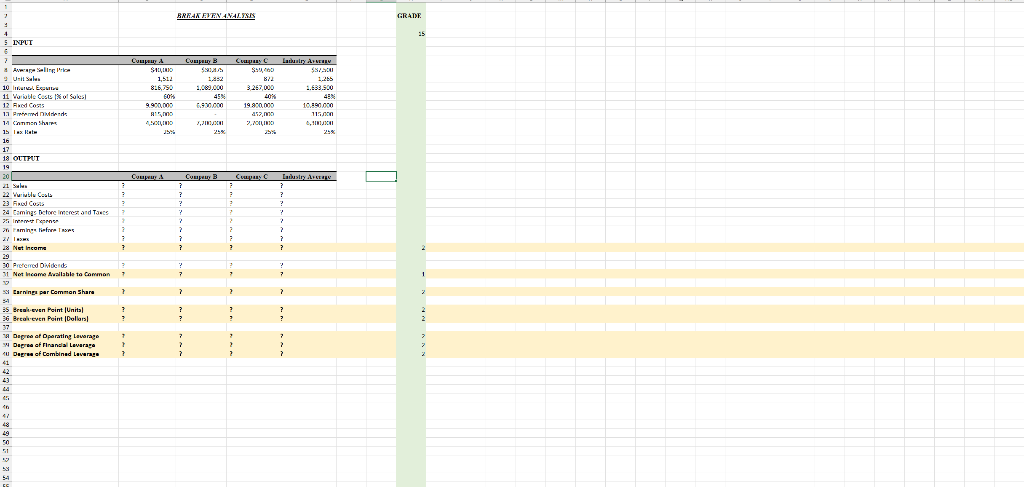

Question: 5 INPUT 7 Unit Sales 10 Ex 11 Variable Costs of Sales) 12 Red Costs 13 Pred 1-1 Commen Sha 15 Tax Rat 16 17

5 INPUT 7 Unit Sales 10 Ex 11 Variable Costs of Sales) 12 Red Costs 13 Pred 1-1 Commen Sha 15 Tax Rat 16 17 18 OUTPUT 19 M 20 21 Sales 22 Vruble Cola 23 Food Costs 24 Camings before interest and Taxes 25 I 26 amintim 2/ 1 28 Net Income * 30 Preferred Divided 31 Net Income Available to Common Earnings par Comman Shara 35 Break-even Point (Unita) 36 Break-even Point [Dollan 37 18 Degree of Operating Leverage Degree of Finandal Lavaraga Degree of Combined Leverage 41 43 44 40 48 49 50 51 12 53 7 2 ? ? 7 7 ; 7 7 ! 7 BREAK EVEN ANALYSIS Company B 59000 1,852 1.000.000 www.www 45% 6.900.000 7,3INCONT 25% Company & A SALINIO 1,512 816,750 60% 9.900,000 815, ALOOLINIO 25% Compeur A ? ? ? 7 2 7 7 ? 7 7 Company B Company C Industry Avvery $$4,000 $5750 1,265 1.683.500 872 3,267,000 Ante 19.800,000 43% www. 10,490,000 115.000 452, no 2,700 25% Company C Industry Aurage ? ? 2 ? 7 7 2 2 7 ? 7 7 7 7 GRADE 15 2 2 7 7 5 INPUT 7 Unit Sales 10 Ex 11 Variable Costs of Sales) 12 Red Costs 13 Pred 1-1 Commen Sha 15 Tax Rat 16 17 18 OUTPUT 19 M 20 21 Sales 22 Vruble Cola 23 Food Costs 24 Camings before interest and Taxes 25 I 26 amintim 2/ 1 28 Net Income * 30 Preferred Divided 31 Net Income Available to Common Earnings par Comman Shara 35 Break-even Point (Unita) 36 Break-even Point [Dollan 37 18 Degree of Operating Leverage Degree of Finandal Lavaraga Degree of Combined Leverage 41 43 44 40 48 49 50 51 12 53 7 2 ? ? 7 7 ; 7 7 ! 7 BREAK EVEN ANALYSIS Company B 59000 1,852 1.000.000 www.www 45% 6.900.000 7,3INCONT 25% Company & A SALINIO 1,512 816,750 60% 9.900,000 815, ALOOLINIO 25% Compeur A ? ? ? 7 2 7 7 ? 7 7 Company B Company C Industry Avvery $$4,000 $5750 1,265 1.683.500 872 3,267,000 Ante 19.800,000 43% www. 10,490,000 115.000 452, no 2,700 25% Company C Industry Aurage ? ? 2 ? 7 7 2 2 7 ? 7 7 7 7 GRADE 15 2 2 7 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts