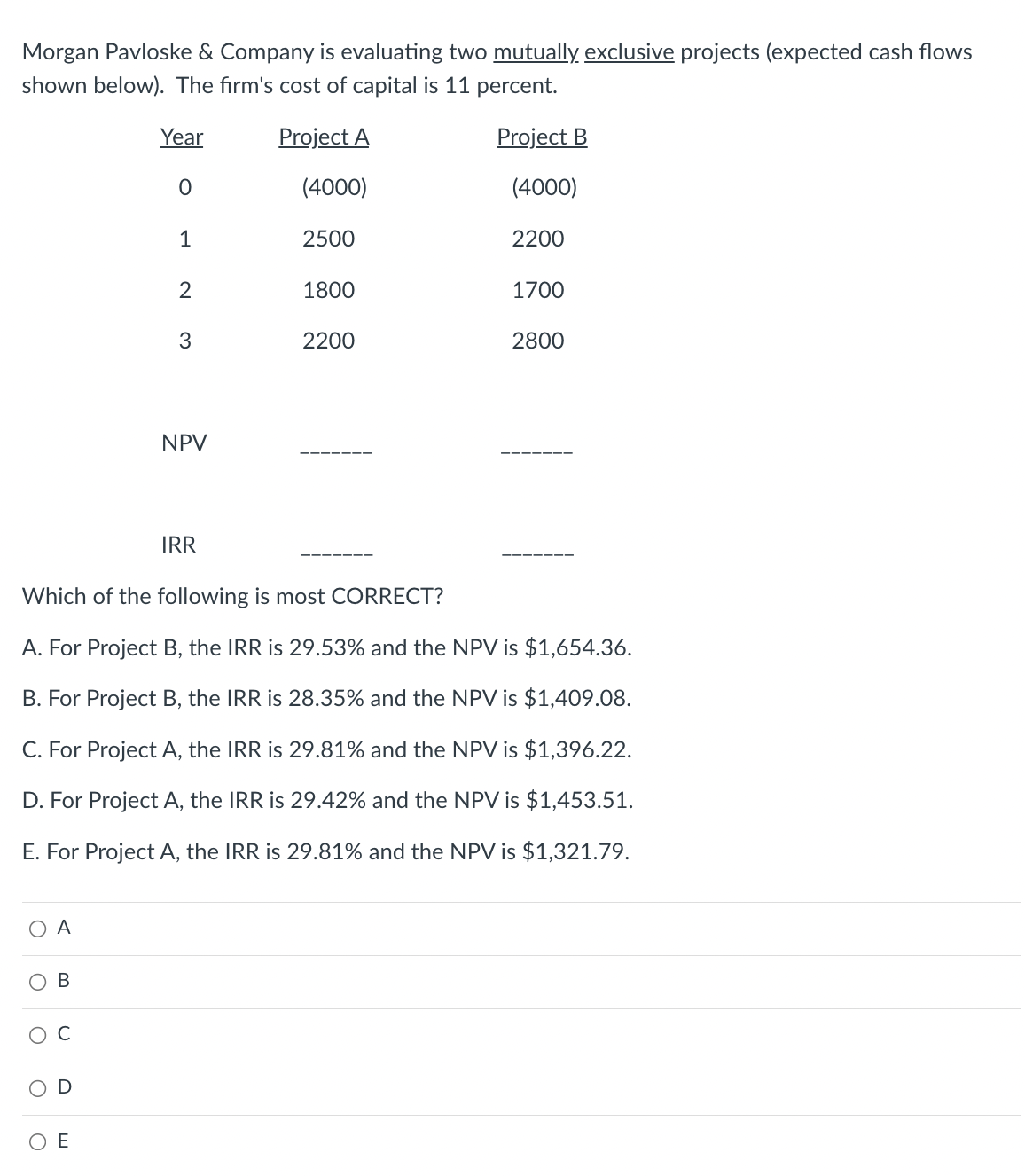

Question: Morgan Pavloske & Company is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 11 percent. Which of

Morgan Pavloske \& Company is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 11 percent. Which of the following is most CORRECT? A. For Project B, the IRR is 29.53% and the NPV is $1,654.36. B. For Project B, the IRR is 28.35% and the NPV is $1,409.08. C. For Project A, the IRR is 29.81% and the NPV is $1,396.22. D. For Project A, the IRR is 29.42% and the NPV is $1,453.51. E. For Project A, the IRR is 29.81% and the NPV is $1,321.79. A B C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts