Question: 5. Option pricing - Single-period binomial approach Aa The value of an option can be calculated by using a step-by-step approach in the case

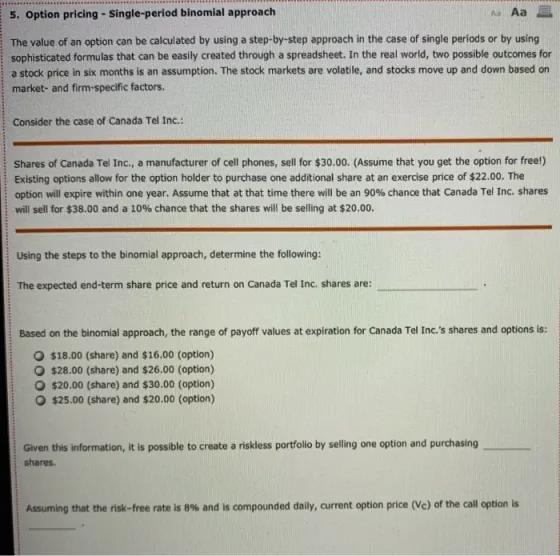

5. Option pricing - Single-period binomial approach Aa The value of an option can be calculated by using a step-by-step approach in the case of single periods or by using sophisticated formulas that can be easily created through a spreadsheet. In the real world, two possible outcomes for a stock price in six months is an assumption. The stock markets are volatile, and stocks move up and down based on market- and firm-specific factors. Consider the case of Canada Tel Inc.: Shares of Canada Tel Inc., a manufacturer of cell phones, sell for $30.00. (Assume that you get the option for free!) Existing options allow for the option holder to purchase one additional share at an exercise price of $22.00. The option will expire within one year. Assume that at that time there will be an 90% chance that Canada Tel Inc. shares will sell for $38.00 and a 10% chance that the shares will be selling at $20.00. Using the steps to the binomial approach, determine the following: The expected end-term share price and return on Canada Tel Inc. shares are: Based on the binomial approach, the range of payoff values at expiration for Canada Tel Inc.'s shares and options is: $18.00 (share) and $16.00 (option) $28.00 (share) and $26.00 (option) O $20.00 (share) and $30.00 (option) $25.00 (share) and $20.00 (option) Given this information, it is possible to create a riskless portfolio by selling one option and purchasing shares Assuming that the risk-free rate is 8% and is compounded daily, current option price (Ve) of the call option is

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

To solve this problem using the singleperiod binomial approach we need to calculate the expected endterm share price the return on Canada Tel Inc shar... View full answer

Get step-by-step solutions from verified subject matter experts