Question: 5 Points - Completing this Excel sheet by making an efficient use of Excel. Must use cell references and / or formulas in green cells.

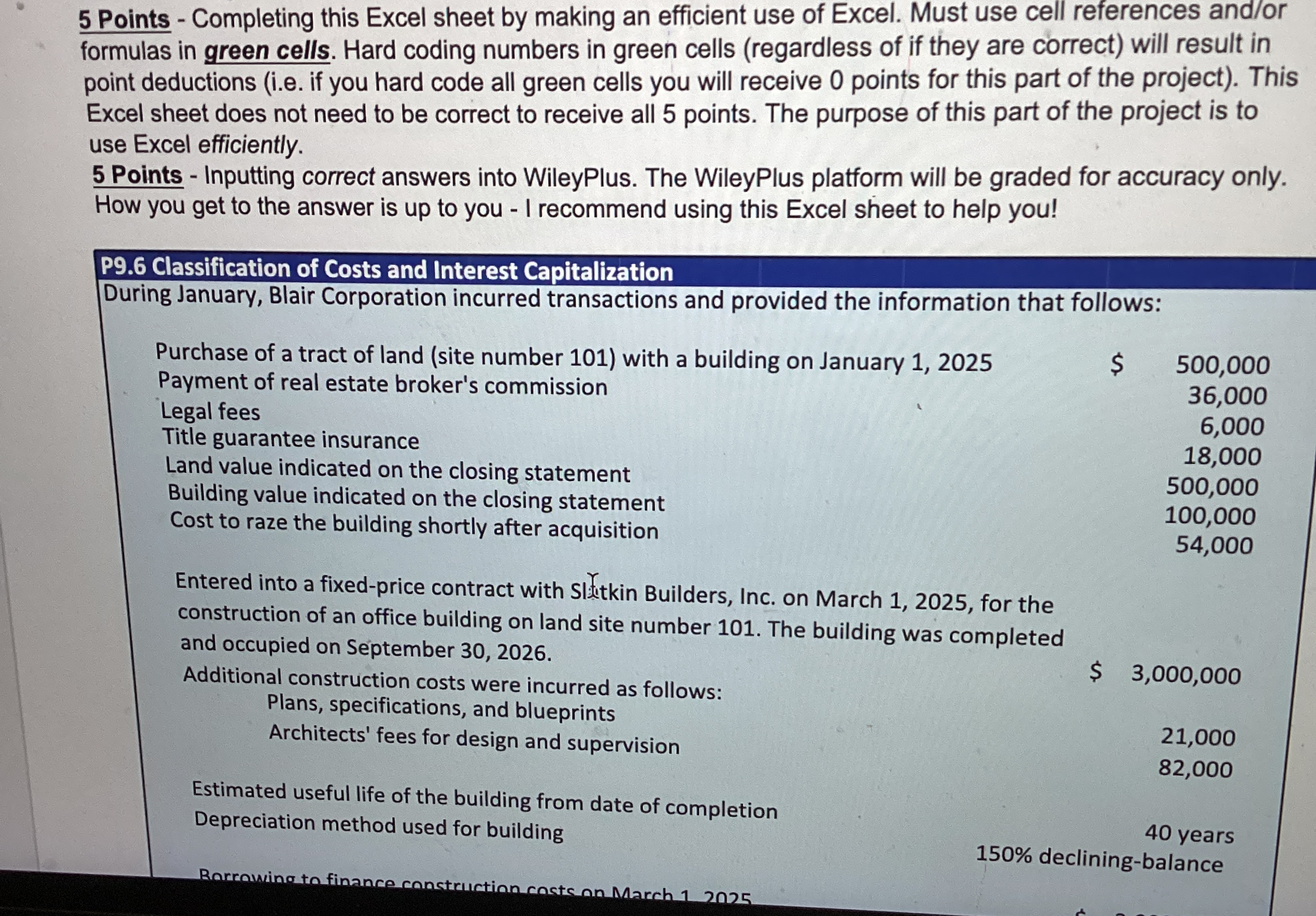

Points Completing this Excel sheet by making an efficient use of Excel. Must use cell references andor formulas in green cells. Hard coding numbers in green cells regardless of if they are correct will result in point deductions ie if you hard code all green cells you will receive points for this part of the project This Excel sheet does not need to be correct to receive all points. The purpose of this part of the project is to use Excel efficiently.

Points Inputting correct answers into WileyPlus. The WileyPlus platform will be graded for accuracy only. How you get to the answer is up to you I recommend using this Excel sheet to help you!

P Classification of Costs and Interest Capitalization

During January, Blair Corporation incurred transactions and provided the information that follows:

Purchase of a tract of land site number with a building on January

Payment of real estate broker's commission

Legal fees

Title guarantee insurance

Land value indicated on the closing statement

Building value indicated on the closing statement

Cost to raze the building shortly after acquisition

Entered into a fixedprice contract with Slitkin Builders, Inc. on March for the

construction of an office building on land site number The building was completed and occupied on September

Additional construction costs were incurred as follows:

Plans, specifications, and blueprints

Architects' fees for design and supervision

Estimated useful life of the building from date of completion

Depreciation method used for building

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock