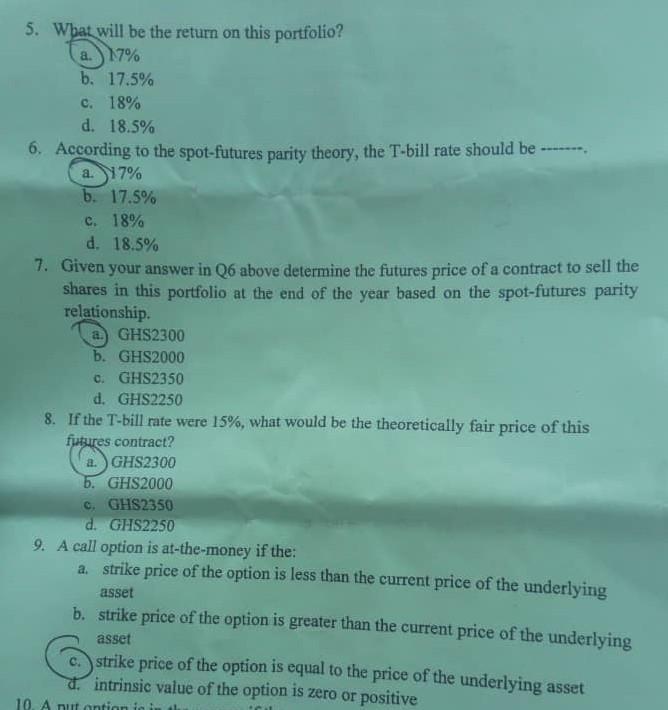

Question: 5. What will be the return on this portfolio? a. 17% b. 17.5% c. 18% d. 18.5% 6. According to the spot-futures parity theory, the

5. What will be the return on this portfolio? a. 17% b. 17.5% c. 18% d. 18.5% 6. According to the spot-futures parity theory, the T-bill rate should be a. 17% b. 17.5% c. 18% d. 18.5% 7. Given your answer in Q6 above determine the futures price of a contract to sell the shares in this portfolio at the end of the year based on the spot-futures parity relationship. a. GHS2300 b. GHS2000 c. GHS2350 d. GHS2250 8. If the T-bill rate were 15%, what would be the theoretically fair price of this futures contract? a. GHS2300 b. GHS2000 c. GHS2350 d. GHS2250 9. A call option is at-the-money if the: a. strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset dintrinsic value of the option is zero or positive 10. A nut option in in the CHL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts