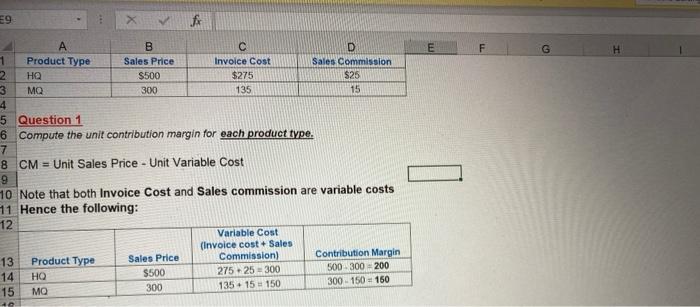

Question: 59 fy E F G A B C D 1 Product Type Sales Price Invoice Cost Sales Commission 22 $500 $275 $25 3 MQ 300

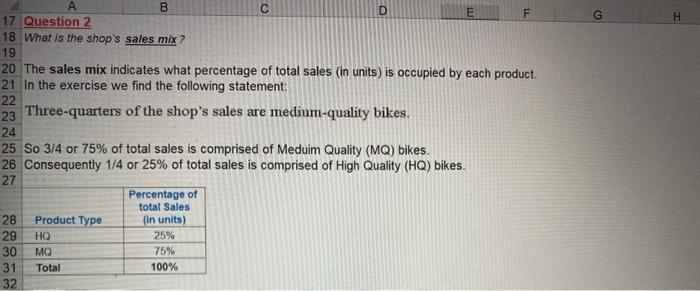

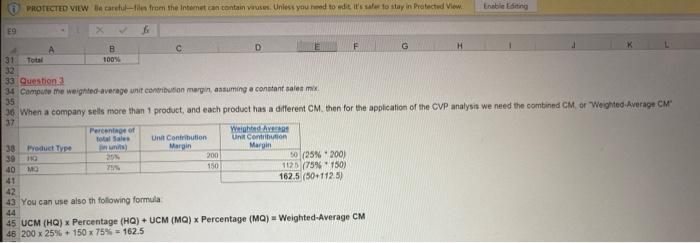

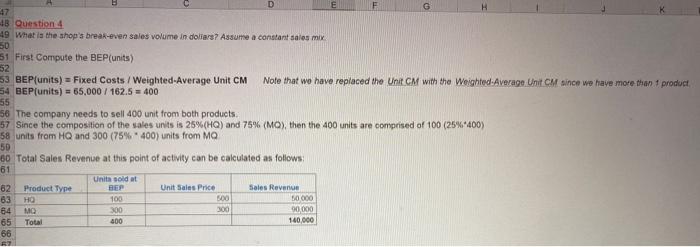

59 fy E F G A B C D 1 Product Type Sales Price Invoice Cost Sales Commission 22 $500 $275 $25 3 MQ 300 135 15 4 5 Question 1 6 Compute the unit contribution margin for each product type. 7 8 CM = Unit Sales Price - Unit Variable Cost 9 10 Note that both Invoice Cost and Sales commission are variable costs 11 Hence the following: 12 Variable Cost (Invoice cost + Sales 13 Product Type Sales Price Commission) Contribution Margin 14 $500 275.25 = 300 500.300 200 15 300 135 15 150 300 - 150 = 150 40 B D F G H E F 17 Question 2 18 What is the shop's sales mix ? 19 20 The sales mix indicates what percentage of total sales (in units) is occupied by each product. 21 In the exercise we find the following statement: 22 23 Three-quarters of the shop's sales are medium-quality bikes. 24 25 So 3/4 or 75% of total sales is comprised of Meduim Quality (MQ) bikes. 26 Consequently 1/4 or 25% of total sales is comprised of High Quality (HQ) bikes. 27 Percentage of total Sales 28 Product Type (in units) 29 25% 30 75% 31 Total 100% 32 HQ MO PROTECTED VIEW Be careful-files from the Internet can contain uses Unless you need to edit it's safe to stay in Protected View Erabieding E9 6 c F G 31 Total 100% 32 33 Question 34 Compute the weighted average unir contribution margin assuming a constant sales mix 35 36. When a company sells more than 1 product, and each product has a different CM. then for the application of the CVP analysis we need the combined CM or Weighted Average CM 37 Percenige of Total Sales Un Contribution Unit Contribution 30 Product Type Margin Margin 39 20 200 50 (25% 200) 40 MO 150 1120 (75% 1150) 41 162.5 (501125) 42 You can use also th following formula 44 45 UCM (HQ) Percentage (HQ) + UCM (MQ) X Percentage (MQ) = Weighted Average CM 48 200 x 25% + 150 x 75% = 162.5 E D -47 Question 4 49 What is the shop's break-even sales volume in dollars? Assume a constant sales mix 50 51 First Compute the BEP(units) 52 53 BEP[units) = Fixed Costs / Weighted-Average Unit CM Note that we have replaced the Unit CM with the Weighted Average Unit CM since we have more than product B4 BEP(units) = 65,000 / 162,5 = 400 55 56 The company needs to sell 400 unit from both products 57 Since the composition of the sales units is 26%(HQ) and 75% (MO), then the 400 units are comprised of 100 (25%-400) 58 units from HQ and 300 (75% - 400) units from MQ 50 60 Total Sales Revenue at this point of activity can be calculated as follows: 61 Unita soldat 62 63 64 65 66 Product Type MC Total 100 300 400 Unit Sales Price 500 300 Sales Revenue 10000 90,000 140.000 68 Question 5 69 How many bicycles of each type must be sold to earn a target net income of $48,750? Assume a constant sales mix 70 71 The formula to calculate sales units sold to achieve a target profit for a single product is the following 72 73 Fixed Costs + Target Profit Note that it is a similar formula to the BEP(units), we just add the target profit to the fixed costs. 74 Unit CM 75 76 The same formula can be used for a multi product company by replacing Unit CM with Weighted Average Unit CM as follows: 77 Fixed Costs + Target Profit 79 Weighted-Average Unit CM 80 65,000 + 48.750 = 700 units 82 162.5 Exercise 7-29 Solution 78 81 59 fy E F G A B C D 1 Product Type Sales Price Invoice Cost Sales Commission 22 $500 $275 $25 3 MQ 300 135 15 4 5 Question 1 6 Compute the unit contribution margin for each product type. 7 8 CM = Unit Sales Price - Unit Variable Cost 9 10 Note that both Invoice Cost and Sales commission are variable costs 11 Hence the following: 12 Variable Cost (Invoice cost + Sales 13 Product Type Sales Price Commission) Contribution Margin 14 $500 275.25 = 300 500.300 200 15 300 135 15 150 300 - 150 = 150 40 B D F G H E F 17 Question 2 18 What is the shop's sales mix ? 19 20 The sales mix indicates what percentage of total sales (in units) is occupied by each product. 21 In the exercise we find the following statement: 22 23 Three-quarters of the shop's sales are medium-quality bikes. 24 25 So 3/4 or 75% of total sales is comprised of Meduim Quality (MQ) bikes. 26 Consequently 1/4 or 25% of total sales is comprised of High Quality (HQ) bikes. 27 Percentage of total Sales 28 Product Type (in units) 29 25% 30 75% 31 Total 100% 32 HQ MO PROTECTED VIEW Be careful-files from the Internet can contain uses Unless you need to edit it's safe to stay in Protected View Erabieding E9 6 c F G 31 Total 100% 32 33 Question 34 Compute the weighted average unir contribution margin assuming a constant sales mix 35 36. When a company sells more than 1 product, and each product has a different CM. then for the application of the CVP analysis we need the combined CM or Weighted Average CM 37 Percenige of Total Sales Un Contribution Unit Contribution 30 Product Type Margin Margin 39 20 200 50 (25% 200) 40 MO 150 1120 (75% 1150) 41 162.5 (501125) 42 You can use also th following formula 44 45 UCM (HQ) Percentage (HQ) + UCM (MQ) X Percentage (MQ) = Weighted Average CM 48 200 x 25% + 150 x 75% = 162.5 E D -47 Question 4 49 What is the shop's break-even sales volume in dollars? Assume a constant sales mix 50 51 First Compute the BEP(units) 52 53 BEP[units) = Fixed Costs / Weighted-Average Unit CM Note that we have replaced the Unit CM with the Weighted Average Unit CM since we have more than product B4 BEP(units) = 65,000 / 162,5 = 400 55 56 The company needs to sell 400 unit from both products 57 Since the composition of the sales units is 26%(HQ) and 75% (MO), then the 400 units are comprised of 100 (25%-400) 58 units from HQ and 300 (75% - 400) units from MQ 50 60 Total Sales Revenue at this point of activity can be calculated as follows: 61 Unita soldat 62 63 64 65 66 Product Type MC Total 100 300 400 Unit Sales Price 500 300 Sales Revenue 10000 90,000 140.000 68 Question 5 69 How many bicycles of each type must be sold to earn a target net income of $48,750? Assume a constant sales mix 70 71 The formula to calculate sales units sold to achieve a target profit for a single product is the following 72 73 Fixed Costs + Target Profit Note that it is a similar formula to the BEP(units), we just add the target profit to the fixed costs. 74 Unit CM 75 76 The same formula can be used for a multi product company by replacing Unit CM with Weighted Average Unit CM as follows: 77 Fixed Costs + Target Profit 79 Weighted-Average Unit CM 80 65,000 + 48.750 = 700 units 82 162.5 Exercise 7-29 Solution 78 81

Step by Step Solution

There are 3 Steps involved in it

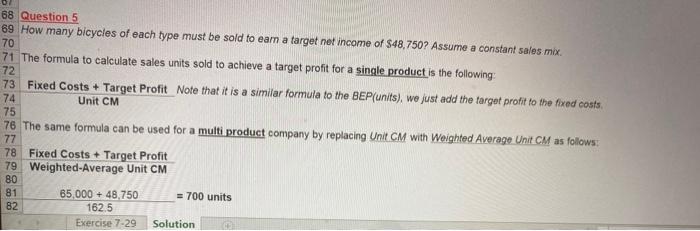

Get step-by-step solutions from verified subject matter experts